- Highly-effective, dynamic combinations of trading concepts you can use to design great strategies.

- The mechanisms you have to master to trade financial markets during unstable economic times.

- How to design a system with strategies for all types of market conditions: trending, reversing and ranging.

- A special focus on exit strategies: stop-setting, trade management and target-placing.

There is a wide array of technical approaches to trade the Forex as we have seen so far. Some are better suited to particular trading profiles and styles than others. This chapter will focus on a selection of trading concepts we have found to be consistently helpful in interpreting market behavior and making price forecasts.

While outlining some of the basic tenets of each strategy, a fully understanding all of the methods requires you to read the original studies by clicking on the links. The aim of this chapter is not so much centered on the strategies themselves, but rather on how they can be used in conjunction, making you understand that strategies can be combined into powerful trading models.

The fist section will give you a general overview of what a strategy is and why the buy and hold mentality can not serve you in the currency market.

The second and third sections cover entry methods for several market conditions. In contrast to Chapter C04, where we have focused on the strengths of many of our experts, this time we want to explore a bit further what strategies they use and how they combine them into fully-flexible trading models.

The forth section takes on one of the biggest myths about trading, namely, that successful entry techniques are what will lead you to consistent profits. There are literally thousands of ways of entering trades, as more and more indicators and trading strategies are developed over time. But the truth is entries are just one component, along with so many other factors which, once combined, can truly lead to consistent results. For this reason, section three will focus on exit strategies and outline several methods to trail stops and project targets.

Please note, once again, that there is no such thing as a secret trading formula. Most of the methods used by our experts are publicly available. It's how you sum the edges that will make a difference.

1. Finding The Edge

The Land Of Confusion

As we have seen in Chapter B04, most of the experts develop personal strategies and over time they shape them to perfectly fit their needs and capabilities. Some of them focus on one particular indicator or pattern, while others use broad spectrum analysis to determine their trades. But the most important thing is that all of them suggest trying a combination of resources in order to make price projections and determine entry and exit points. Through persistent research and practice they have decided what works best for them.

Basically speaking, a strategy consist in using proper indicators in order to analyze a financial instrument and thereby obtain clear signals as to when to profit from a price move. These indicators can be of a technical or fundamental nature, and strategies can use one either type or be a combination of both.

With every advantage that any strategy presents, there is always a disadvantage to the technique. That is why we promote the combined use of strategies. Just like many heads, several indicators are usually better than one!

Nothing in trading works 100% of the time. There is always a certain level of unpredictability to the markets and what traders seek to do is to have a legitimate edge which helps to turn the odds in their favor. As you proceed through the chapter, you will notice that we reintroduce many of the trading concepts, these so-called “edges”, gained from previous lessons. These, combined with expert strategies, will provide you with enough material to build a versatile and robust trading model of your own.

We suggest you follow a certain order in the way you add tools and techniques to your trading arsenal, and that go on building your method step-by-step. Throughout our educational material, you will find many ideas and lessons on how to trade certain set-ups.

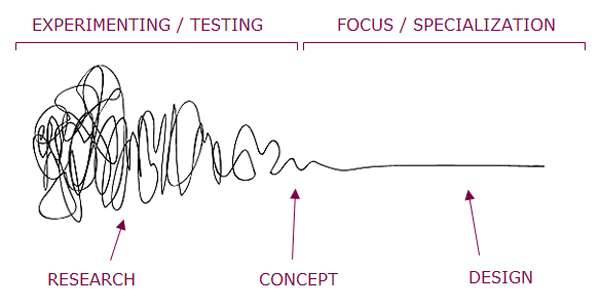

The image below illustrates the process of exploring endless possibilities, through establishing tradable concepts, up to maturing a system design. The initial disorientation gradually shifts into a focused discipline.

At this stage you are probably able to recognize a trend-following method from a range-trading or a counter-trend method. The reason why different methods are categorized according to the market condition may lead you to think that market phases are easy to differentiate, but they aren't. It remains a subjective issue in itself, but within this frame of subjectivity you can find your own objectivity. What do we mean by this?

What all traders ultimately aim for is to adhere to price, enter the market and follow it for a while, and exit with a profit. From this perspective, you always go where the price goes- even if the price is trending, ranging or reversing from a technical point of view.

Based on this principle, the starting point when designing a strategy is to define what the trending condition is. This is important because if you don't know how to recognize a trend you can't know how to define a ranging condition. Following the same logic, the elements used to identify a ranging market will allow the trader to know when is best to apply a counter-trend strategy.

By the end of this chapter you should be geared with additional concepts on how to trade in all three market conditions. This will hopefully enable you to participate in those difficult situations where you usually stand aside. In order to do this, it's obvious you should be able to understand the importance to build a trading model that is able to objectively categorize market conditions and ideally enable you to trade in all of them.

Bundle Strategies For Different Market Conditions

Van Tharp points to the difference between the buy-and-hold investment strategy and a structured and systematic trading approach. The first tactic, employed by many equity investors which appeared to be working quite nicely during the extended bull market up to the latter stages of 2007, has proved disastrous as the market collapsed afterward. Now more than ever, anyone wanting to profit in financial markets has to master much more versatile techniques because of increased volatility and risk in the financial markets. Van Tharp recalls those one-directional, bull-market times by explaining:

In 1999, everyone in America seemed to be a stock market expert. For example, we were giving a stock market workshop at the Embassy Suites in Cary, North Carolina and one of the bartenders said to the other, “Perhaps we should take Dr. Tharp’s Stock Market Workshop.” The other one responded, “No, I don’t need that. I could teach a workshop like that.”

Similarly, a waiter in a high-class steak restaurant informed us that he was really a trader, but that he works at a restaurant part-time at night. He had already made over $400,000 trading and considered himself to be an expert trader. However, my guess is that those people did not survive the markets from 2000 to 2002, much less the market we have seen in 2008.

Why? They are different markets, and a strategy of buying and holding high tech stocks that worked in 1999, had mixed to horrible results in the years since 1999.

Kel Butcher points to the same phenomena in one of his articles:

...these people were throwing money into the market on a whim in order to be part of the action, and make their fortune share trading ‘in as little as one hour a day’. Unfortunately, they had no real idea of what they were doing. Nor did they have an understanding of the concepts of risk management and money management.

Over exposure, lack of a trading plan, and disdain for money-management concepts wreaked havoc when the market crashed. Cash margin calls, the forced sale of shares and, in some cases, other assets to meet margin calls added more fuel to an already raging inferno.

[...]

Actively managing your share portfolio – cutting losing trades, knowing where and when to exit profitable trades, understanding money-management and position-sizing techniques – is the only way to ensure success in any market.

When comparing currency trading with other investment vehicles, Joseph James Gelet states that trading in the Forex is a “market neutral” type of investing, since you are not buying or selling anything. Traders are instead exchanging- which is a different and challenging concept for many neophytes. About trading in unstable time, he writes:

In a bad economy, where do profits exist? How does one identify the right opportunity? Most traditional investments, i.e. stocks, bonds, and commodities, are connected to the real economy. In other words, they depend on sales by consumers and other businesses. Even the price of oil has a demand function, if businesses are closing and purchasing less oil, the price will fall. Companies that sell a product, even a necessary product, depend on consumers. 75% of US GDP depends on the US Consumer, who has less money and available credit than ever before. Even if you have the best product in the world, if customers don’t have money to buy, it’s difficult to sell.

A market neutral Forex system doesn’t have any product, it trades money for money. Europeans have a demand for Dollars and Yen just as Americans have demand for Euros and Pounds. Whether the dollar goes up or down, as long as the US economy exists, someone somewhere will have a demand to trade Dollars. This means there are constant opportunities for buying and selling – the key is to trade actively and not take a major position on market direction, and to cut the losses and ride the gains.

Detaching from the need to be right on every entry is, besides a psychological goal, an important aspect when developing a trading method. Should any strategy you come up with know what the direction of the dollar will be in the next hours or tomorrow? The answer is simply: no, and you should not care about it at all. Forecasting the direction of currencies is much more difficult, to say the least, then deciding what to do if prices go up and what to do if it goes down.

A market neutral system, build of several strategies, should run in any type of market, hence the name “market neutral”. That doesn’t mean it’s infallible, this statement is simply contrasting a versatile trading approach with the traditional buy and hold method.

Know Your Strategies

Building strategies can be fun, easy and surprisingly quick. You don't need to spend thousands of dollars looking for a great trading strategy. We will show you several concepts on which you can develop great strategies.

Besides, developing strategies on concepts that work makes it much easier to stick to your trading plan and even more so if the strategies are the result of your own work. A complete understanding of the rules behind our trading systems means the trader understands why they are generating specific signals at all times as well as the concepts behind them. If you understand the series of events that occurred to make a buy or sell signal happen, you will have the ability to repeat that action consistently.

A good trader who is able to continually adjust their system design to adapt to changing market conditions should also have the confidence to execute each trade with a high degree of certainty that the odds are favorable.

This is easier said than done. So let's get down to business.