3. The Market Structure

Although we track the start of the Forex in the early 70's, the lack of a central marketplace for transacting foreign exchange made difficult for importers and exporters to accurately track daily movements in the currencies. In fact they had no prior experience with floating exchange rates and therefore no in-house expertise. They were at the mercy of the banking industry, specially the big banks for whom foreign exchange became a huge source of revenue.

The first foreign exchange brokers came on stage in the mid 70's to offset a significant customer foreign exchange business for medium and small banks, which needed continuous exchange rates in the major currencies.

Initially the foreign exchange brokers installed direct lines to all the banks willing to participate. Generally a major bank made a rate and the brokers showed the rate to all the banks at about the same time. The first bank to deal on the rate completed a transaction. The others waited for the next rate. Any bank could make a rate; show a bid or an offer. Soon, with the aid of new technologies, the brokers became quite sophisticated and efficient at putting together a continuous two-way price and using the banks as their primary liquidity providers.

The Interbank Market

When speaking of Forex at a governmental level (central banks) and institutional level (commercial and investment banks), we refer to a market which, nowadays, negotiates over 3 trillion Dollars a day. At this level, exchanges of 5 to 10 million are frequent, but also amounts of 100 to 500 million are traded between major participants.

It's an interbank or over the counter market (OTC) and spot market, meaning it is not done through an exchange. Unlike most other exchanges, the Forex market is not a centralized market where each transaction is recorded by price dealt and volume traded. There is no central place back to which all trades can be traced and there is not onemarket maker but many.

Each market maker records his or her own transactions and keeps it as proprietary information. The primary market makers who make bid and ask spreads in the currency market are the largest banks in the world. That literally means banks constantly dealing with each other either on behalf of themselves or their customers. This is why the market on which banks conduct transactions is called the interbank market.

Larger speculators also operate in the interbank market where they can execute multi-million Dollar trades with ease.

Individual traders, who generally trade in much smaller sizes, primarily do so through brokers and dealers.

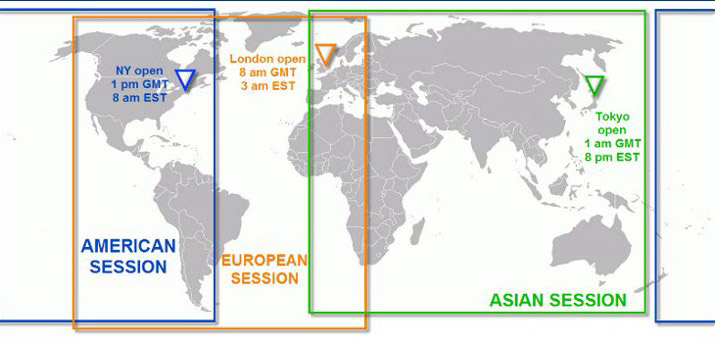

The negotiated volume is particularly concentrated in London, but also in New York and Tokyo. These cities are also major trading and decision centers for monetary matters because of their sheer size in turnover and number market participants also because the happenings in these places tend to influence other dealing centers around the world. Other important locations at this level are Sydney, Switzerland, Frankfurt, Singapore and Hong Kong.

Many of today's major currencies fluctuate freely between each others and are negotiable virtually throughout the world. This has resulted in increased speculation by banks, hedge funds, brokers and individuals. Central banks occasionally intervene with the intention to move the currency towards desired levels, however, the underlying factor that leads the Forex market are the forces of supply and demand.

The lack of physical change enables the exchange market to operate 24 hours a day, 5 days a week, covering different areas across the most important financial centers. Its tremendous volume of transaction makes it very liquid and therefore highly desirable to trade. Currencies are the most traded assets in the world - any commercial or financial flow across borders may involve a currency exchange.

Dar Wong comments on the time zones, by stating:

Generally speaking, the first market to begin trading is in the Asia-Pacific zone with the New Zealand and Australian markets. Their opening is followed by Asian financial centers in Japan, Singapore, and Hong Kong. Then, the European markets open in Switzerland, Germany and London. When the Asia-Pacific and Asian markets end their business day, the market activity flows into the opening hours of Canada, followed by the New York session. Just before the New York session ends, another trading day begins in the Asia-Pacific zone.

Thus, it is important to strategize your local time according to the around-the-clock activities of the Forex markets, in order to maximize your potential profits from the market movements.

The two most active times through a full 24-hour market day are the London and New York sessions. The reason is that the major currencies like the Pound (GBP), Euro (EUR) and Dollar (USD) move most frequently in these two sessions. This coincides with the impact of each currency's regularly released of economic figures.

In summary, we may conclude that the first market to begin operation every week is the New Zealand market early Monday morning and the last market to close at the end of the week on Friday afternoon is the New York market. In Asia, this means that the weekly round-the-clock operation of the Forex market begins in the wee hours of Monday morning and runs to Saturday morning.

Price actions like breaks of previous high or low levels and intraday trends are usually more significant at the start of the London session and during the overlapping period of the European and American sessions. At the end of the American session and during the Asian session, be careful with price actions since a lower volume may generate false breakouts and technical signals. By studying chapter 4, you will become well versed in all these aspects of price action.

Until the popularization of Internet trading, FX was primarily the domain of government central banks and commercial and investment banks. With the increasingly widespread availability of electronic trading networks and matching systems, trading on the foreign exchange is now more accessible than ever.

The market has been rendered feasible to non-banking international corporations like hedge funds, which can now trade via intermediaries thanks to those networks. They are the high level that really moves the currency market buying or selling huge amounts in the mid to long term: their time frame is generally weeks to months, possibly years. Their transactions unbalance the market, requiring price adjustment to rebalance demand and supply.

The volume negotiated is particularly focused in London, but also in New York and Tokyo. These cities are also major trading and decision centers for monetary matters. Other important locations at this level are Sydney, Switzerland, Frankfurt, Singapore and Hong Kong.

The presence of such heavy weight entities may appear rather discouraging to any aspiring trader. But the fact is that the presence of such powerful entities and their massive volume in transactions can also work to your benefit as a trader.

It is important to note that even high-level financial institutions are vulnerable to market movements and are also subject to market volatility as all the other smaller participants. In practical terms, this means that the market is too big for a single participant to control it and that the alleged insider information that large banks have is of very relative value compared to the size of the market.

Individual traders, in turn, do not move the currency market so much. Their time frame is usually much shorter and so is their investment horizon. Therefore they do not impact the demand/supply equilibrium in the aggregate in the same way, nor their positions have a lasting effect on the currency prices. But on the other hand, their trading models and lower volumes allow more flexibility to enter and exit the market (see Francesc's blogpost Retail Forex Represents 12 Percent of Total Forex Market Volume in 2009).

Higher time frames express the intentions of bigger players. Take this into account when approaching the supply and demand tutorials in Chapter A04.

At this point it's interesting to note that the trading activity of each financial center will determine the behavior of the market. Thus when the London markets open and the session starts, it's still overlapped with the last two hours of activity in Tokyo. Position openings done by London traders and the closure of positions in Tokyo coinciding in a interval of two hours may explain the increase in activity and volatility around this time. Later the European and the US session match during 4 hours in a combination of players, significantly increasing liquidity.

It's worth mentioning the importance for the retail trader to be aware of the most recent leading center's trading activity. This applies not only to market activity, such as the announcement of economic data, but also inactivity. So if these centers are together or separately on holiday, do not be surprised when trading tends to go quiet. Hence it's a good idea to check the Economic Calendar for major international holidays when doing your market research and planning particular trades.

Any readings of a sudden movement during an otherwise less active period can point to a false alarm. Perhaps it's just one large participant, such as a hedge fund, who has made a big transaction. Not finding much volume, the market records the hedge fund's transaction as a spike out of previous price ranges.