4.Technical Main Course

Harmonic Patterns with Oscillator Divergence

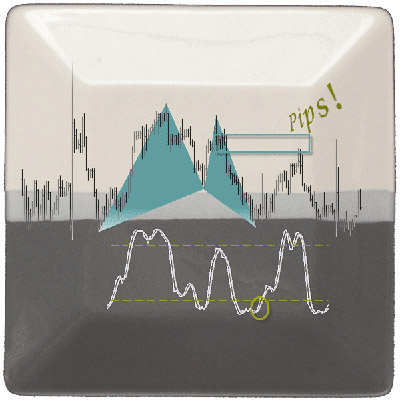

This is the so-called Butterfly pattern, also a Gartley variant. We could say it is the pattern which forms when the classical Gartley fails and the D point surpasses the X point. Attention: this is a highly lucrative reversal tactic not suited for trend followers.

When breaking down a chart, what you want to see is the psychology of the other players participating in the market. Although ultimately there are fundamental events and factors like interest rates, government policies, economical data, etc., prices move because of the beliefs people form about those events.

The Gartley pattern is meant to trap the traders who believe they are facing a 1-2-3 formation: they go long (in a bullish formation) after the price has resumed, above the B point, with stops allocated just below, precisely the area where price drops into before reaching higher highs.

Sunil Mangwani's idea is to trade down from A to B in a countertrend fashion, or to trade in the direction of X-A but only after point D has formed. The pattern is valid as long as point D is not below point X.

There are precise instructions to know if a reversal at A is low risk. One thing you can do is to measure the pattern with the Fibonacci ratios.

Another effective tactic is to combine the Butterfly with a Stochastic Divergence. For example, when price is making higher highs on the way up between points B and C and the oscillator is printing lower highs.

This set-up requires you to identify the pattern while it is forming, not when it is completed. But to do that you have precise instructions delivered by Sunil Magnwani.

There are other ways to enter trades based on harmonic patterns: notice how Sunil mentions some basic ideas about support and resistance pointing to the lessons of Sam Seiden. This is the kind of affinity you want to see from your educators!

Harmonic Patterns, by Sunil Mangwani. Compare the above chart and the one on the video to see how well the trade was managed by reaching the first target to the pips, and protecting the rest of the position with the stop at break-even.

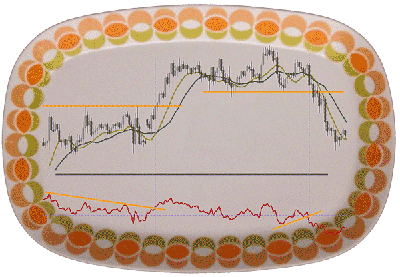

Trendlines on the RSI

The rules to trace a trendline on the indicator are the same as on the chart: at least two contact points are needed to establish the line. Oftentimes, the contact points in the indicator, being the highs and lows in its curvature, coincide with swing highs and lows in the price action. Nevertheless, it's worth mentioning that a trendline in the indicator is independent from a trendline on the chart. There is no need to have an identical line, with the same length and angle than the one on the chart to be able to trade a line based on the RSI, for instance.

The set-up introduced by S.A. Ghafari is to capitalize on breakouts in the indicator. These breakouts often anticipate those of the chart levels.

In the webinar Catching Redfish off the pool: Trend Lines and Technical Indicators, S.A. Ghafari explains a lot of techniques to be used in trend following environments. The one we picked up here is just one of the many.

This versatile technique can be used as a filter, as a trigger or even as an exit signal. Either way you are adding a confirmation tool to your system by simply using the indicator creatively. In the example below you can see a signal from a moving average cross over, plus a break of a S&R level being confirmed with a break of an upward/downward sloping trendline on the RSI.

Lines can be drawn in other indicators such a the MACD, Momentum, CCI, and so forth. An important aspect to consider when placing the line is deciding with a certain anticipation in which direction we want to take the breakout. The most efficient way, although not imperative, is an RSI breakout caught when the main trend on the chart is down and the line on the RSI is upward sloping.

Triangles can be also drawn in the indicator line. The particularity of this set-up is that on the chart there is no triangular formation in sight, just an amorphous consolidation. That allows the trader to anticipate an eventual breakout.

Pivot Point Nuances

Andrei Knight regularly delights us with his “Institutional Trading Strategies” and “Fibonacci Friday” webinar series. But for us, the singularity of his teachings is the refined and elegant approach he shows when trading the Forex. All indicators on his price chart are meant as support and resistance levels, and each indicator has a precise role to accomplish. One of these indicators, the Pivot points, have long been a favorite of the biggest institutional players. For this reason it's of utmost importance to have them well calibrated and to be geared with a few guidelines on how to take the most profit out of them.

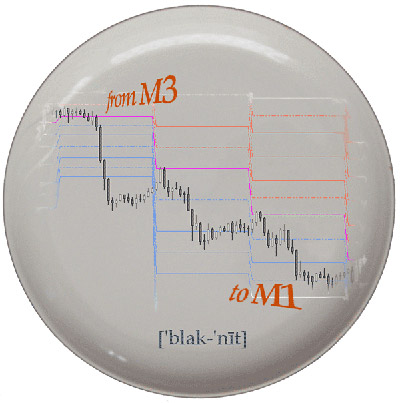

Price movements that start on a daily Pivot are likely to end at a daily Pivot, the same as one starting at a weekly Pivot is likely to end on a weekly one, and the same for monthlies. Movements between the median levels happen in a similar way, but in this case if a movement starts at, let's say, M1, it will mostly go to M3, thus skipping M2. And conversely, a movement that starts at M3 typically will go to M1.

For an intraday trading approach you may start by plotting the daily Pivot Points on the chart.

Andrei defines a profitable trade as an intersection of a diagonal line and an horizontal line in the same sense that an opportunity could be defined as the intersection of luck and preparedness. Now that you are more than familiarized with the concept of technical confluences, mentioned so many times along the Learning Center, it's also time to get the most from a trading approach as Andrei Knight's.

Just try to plot the Pivot Points on a chart and observe what happens to price at the intersections of the Pivots with other support and resistance indicators, such as moving averages or price envelopes. Your will be astonished.

Another fine nuance on the idea of confluences and intersections is the protecting effect a clustering of several indicators can offer to any trader. Installing a rule to not enter any position if it is not protected by at least three clustered support or resistance levels on the chart is an enormous edge you can be thankful to have found.

The other big lesson, so simple and so many times overlooked, is the fact that most of the breakouts are false breakouts. For this reason a retest of a broken level is always a better guarantee the broken level will hold, and therefore a much better entry than on the breakout alone.

These rules will not work 100% of the time, in fact nothing in trading does, but they will work far more times than they won't.

A very detailed description of Pivot Points by Andrei Knight, how they are calculated, how to calibrate them to your time zone, why you should follow these calibrations, and how to work with them. As always, we strongly recommend to study all webinars given to any one of our contributors, to get acquainted with their tools and add a few more edges to your trading.

Calibrating Indicators with Fibonacci Ratios

There are some set-ups that feel more natural to you, those set-ups that you detect better than others. This is a point that many of our experts mention in their lessons and although it is difficult to fully understand at the beginning, it is one of those things that will become clearer and clearer with time.

For example: you may develop a special feeling to identify flag patterns in very short time frames, where others just see noise. Or you may detect pullbacks to broken support and resistance levels while another person will better thrive at picking divergences.

There is one type of trades that you will be taken more often because your attention is focused on it. This is what leads you to gain experience in a certain type of set-up, the same way you specialize in a specific business. As a trader, you are not only going to trade for the sake of trading, you are going to build a business around a specific concept that you plan to capitalize on.

Trapping the price is an interesting analogy used by Wayne McDonell, which means you are stalking the market by analyzing it, and you do it by knowing well your pair, your time frame, your market session, in a way that you are also able to put a trap for the price. If the price falls under the trap you have a trade, if not, just start your analysis again and set another trap based on the same observed principles. This is what Wayne calls being in control of your trading.

Strategic & Tactical FOREX Trading (Part 1), by Wayne McDonell.

In order to gain a certain level of confidence, one of the things you may do is to experiment the parameters of the indicators. Numbers from the Fibonacci sequence can be used to calibrate technical indicators, for example: moving averages can be set at 3, 5, 8 or 13 periods. A combination of a 3 and 5 short moving averages is a good indicator for momentum: the steeper the angle is and the greater the separation between the moving averages the higher the momentum is. This is also a measure of confidence - if you know momentum is high and technical indicators confirm it, you will better trust your actions based on that evidence. Conversely, if you see the moving averages braiding then you know there is indecision in the market and momentum is weak.

The good thing about short moving averages is that you can identify a quick turn upwards in a falling market or a quick dip in a rising market and react to the price action.

Wayne uses a combination of moving averages calibrated to 21 and 55 periods (both Fibonacci numbers) to verify the speed of the market. Also his MACD set to 21, 55 and 8 combined with a stochastic 8, 3, 7 are an example of how indicators can be calibrated with other parameters than the standard ones and still be very effective.

It all depends on how you read the market and not what the indicator is telling you. Many aspiring traders expect the indicators to dictate them when to buy and sell, aiming to reduce the trading activity to a mere execution process, but this is far from reality. Your task is to read what the market is doing and your indicators choice and the parameters used are simply the tools to achieve that.