Topics covered in this chapter:

- The case of US trade deficit as a starting point to build your global picture.

- Why Bretton Woods carried the seeds of its own destruction.

- Who makes the exchange rates and how they are made.

- How major participants deal with each other in the interbank, the wholesale market.

- The global currency markets are mostly inhabited by banks, but brokers and dealers create the market at the retail level.

- How a retail broker interacts with the interbank network.

- Technologies and liquidity aggregators that shape the market.

- Choosing a broker: main criteria in a due diligence process.

1. Global Trade And The Currency Market - The Big Picture Matters

Before going into the interbank world and then examine the dealing processes, let's have a second look at some key underlying economic principles of the modern history of global trade and capital flows, partly covered in the previous chapter, and see why these developments still matter today.

As you learned in Chapter A01, representatives from 44 different nations who converged at the Bretton Woods conference in 1944 were determined to cobble together a system that would prevent additional depressions and to ensure a fair and orderly market for cross-border trading conditions. Most countries agreed that international economic instability was one of the principal causes of WW II, and that a new system was needed to facilitate the reconstruction process.

At that time the US was not prepared to pay with their surplus the debt of the countries ruined by war. And these, in turn, did not want to depend forever on the US economy. As a result, an agreement was reached halfway: the conference produced a new exchange rate system which was partly a gold exchange system and also a reserve currency system, with the US Dollar as a de facto global reserve currency.

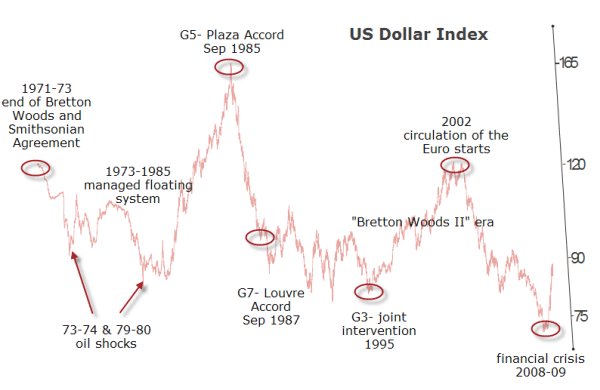

While in the early 70s many economists supported the idea that the gold-US Dollar peg was not the best regime for a growing international economy, a completely free floating exchange rate system was neither seen as favorable as it could end up in competing devaluations, the destruction of cross-border trade and ultimately lead to a global depression. The Smithsonian Agreement was an attempt to reestablish a fixed rate system but without the backing of gold.

The value of the Dollar could fluctuate in a range of 2.25%, unlike the previous range of 1% during the Bretton Woods. However, this agreement also failed in the end. Under heavy speculative attacks, the price of gold shot to 215 US Dollars per ounce, the US trade deficit continued to rise and the Dollar, therefore, could be devalued more than the 2.25% limit band set in the agreement. Because of this, the currency markets were forced to close in February 1972.

Currency markets reopened in March 1973, when the Smithsonian agreement was already history. The value of the US Dollar would be determined by market forces, and not be confined to a trading band or be tied to any other asset. This allowed the Dollar and other currencies to adjust themselves to the global economic reality and paved the way for an inflationary period never seen before in modern times.

The political understanding that underpinned Bretton Woods is of importance here, as the United States made itself the core of the new system, agreeing to become the trading partner of first and last resort. This has obviously tremendous implications on monetary matters. Although this has apparently no direct implications on your daily trading, it is a key aspect to understand the market flows and many of the monetary decisions taken by nations through their monetary authorities.

While nothing that has been discussed in the previous chapter is wrong, it is only part of the story. For you as a trader and investor, there is a political dimension of the current system that matters, as it can condition your career at some point. If you learn to identify the underlying forces that move the capital flows, you will be able to develop trading strategies that fit the big picture.

In words of Van K. Tharp, author of Trade Your Way To Financial Freedom:

I now recommend that all of my clients develop a business plan in which they play out their own long-term scenarios for trading. In that plan you must ask yourself, What do you think the big picture will be over the next 5 to 20 years? And the answer to that question will help you focus on the markets to trade and the type of trading you might want to do.

As I was laying out my version of the big picture for you, it suddenly dawned on me that what I'm suggesting is that everyone do some form of mental scenario thinking as the basis for your trading. At one level, you can focus on the big picture as I just did and come up with markets that you want to concentrate on with some expectation of the type of results you can get. Or, as an alternative, you can drill down into the big picture on a regular basis and become more and more of a mental scenario trader-investor.

Without an explicit mechanism like a gold exchange, the similarities between the original Bretton Woods system and its more recent counterpart are interesting and instructive. Not only the system still relies on the willingness of the participants to actively support it, but also today's system is characterized by the economic and political relationship the US has with rapidly emerging economies.

For a time, the original Bretton Woods system seemed to favor all nations involved. Considering the desperation and destitution of European countries and Japan, ruined by the war, they were willing to accept nearly whatever was on offer in the hope of their rebuilding process. They were totally dependent upon US willingness to remain engaged. On the other side, in view of the unprecedented and unparalleled US economic strength, economic aid packets were the obvious way to go.

These emerging countries rebuilt their economies on the backs of their growing export markets. The United States would allow Europe nearly tariff-free access to its markets. The sale of European goods in the US would then help Europe develop economically and, in exchange, the United States would receive deference on political and military matters: remember, by then the NATO was born.

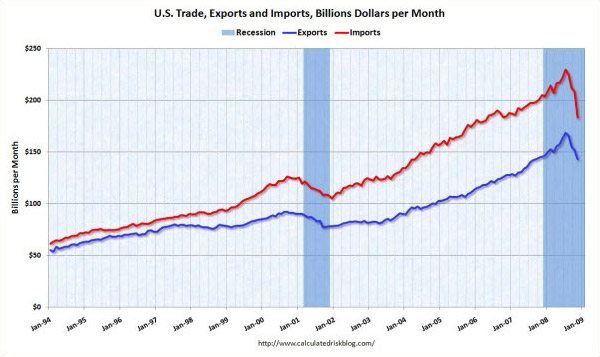

In the US growing affluence increased the demand for an ever-growing array of products from overseas markets. Predictably US imports grew and so did the US trade deficit. A trade deficit increases when the value of imports exceeds that of exports, the opposite of a trade surplus. In textbook economic theory, market forces of supply and demand act as a natural correction for trade deficits and surpluses. One would expect the value of a currency to appreciate as demand for goods denominated in that currency increases.

For updated data on the US trade deficit please visit the US Census Bureaus's website.

Here's a brief video explaining the concept of the current account which will help you understand trade flows, deficits and surpluses.

What happened however with the Bretton Woods arrangements was that the exchange rate system mandated the foreign central banks to intervene in order to keep their currencies from exceeding the Bretton Woods target levels.

They did this through foreign exchange market purchases of Dollars and sales of other currencies like British Sterlings, German Marks and Japanese Yen.

This procedure resulted in lower export prices from these countries than what market forces would predict, making them still more attractive for US consumers, thus perpetuating a mutual dependency on the system.

Whereas in the original Bretton Woods the greatest limiter was the availability of gold, now it has become and remains to be the whim of the US governments monetary authorities.

Once the monetary system discussed in the Bretton Woods conference was configured according to the US plan, the chance of having a means of payment to cover the needs of international transactions and to establish reserves to address potential deficits, that is, to have the necessary international liquidity, was given by the gold reserves and US Dollars of those countries with some power over the International Monetary Fund.

As many economies grew, more Dollars were demanded to be used in international trade. The fundamental dilemma was: on the one hand, the US had to print more Dollars and run a balance-of-payments deficit in order to satisfy that growing liquidity demand; on the other hand, a continued deficit led the US Dollar to a loss of credibility as a sound reserve currency.

After the WW II, the United States was the only country able to provide all the material needs for the reconstruction. European countries did not have enough Dollars and, since their reserves were low, they had to become debtors of the United States, which meant that their balance of payments would have a surplus. There was no other solution than to "beg" the Unites States to run a balance-of-payments deficit, which by the way was also in the interest of the US.

The perpetuation of US deficits year after year would inevitably entail substantial risks for the gold convertibility which was the backbone of the system. But the only way to provide international liquidity, given the limited flexibility in the extraction of new gold, was deficits in the north-American balance-of-payments or, put in another way, that other countries would deliberately run a surplus in their balance-of-payments by accumulating Dollars.

To this contradiction between the need for Dollars (hence need for US deficits), and the confidence in the Dollar's convertibility to gold (based on US metal reserves), we must add another aspect of the system. This aspect discriminates different countries in relation to the US creating an asymmetry in their economical decision taking processes: if a country had a deficit in its balance-of-payments and expected the situation to continue, that country was under the obligation to proceed with an internal deflationary policy. Ultimately, because the lack of sufficient reserves, the country had to take contractionary measures to devalue its currency. But the US, being the creator of the system's underlying currency, was not forced to take that kind of action.

A revival of Bretton Woods?

Much of the arrangements the Bretton Woods system brought into existence continue to be relevant in today's global market. Some observers call it the "Bretton Woods II" making reference to the system of currency relations in which currencies, particularly the Chinese renminbi (Yuan), remained pegged to the US Dollar. The argument is that a system of pegged currencies is both stable and desirable although this notion causes considerable controversy and opens the question: how long a system of heavily managed exchange rates as seen in many emerging market economies will last?

The answer depends on the expectations of the US creditors, mainly the Asian economies. The similarities between the original system and Bretton Woods II are evident: the US deficit, the US loose monetary policies, the fixed pegs to the US, and the massive ongoing reserve accumulation by Asian central banks. These exchange rate policies can lead to an inflation rise in those emerging economies forcing them to abandon the pegs and/or letting currencies appreciate at a faster rate as a necessary step to control inflation.

Over the very long term, economies move in cycles and what were yesterday's emerging economies, like Japan or Germany, become today's stable, mature markets while other countries step into the role of the emerging countries and join the globalization party, such as the case of China, India, or Brazil. Suddenly it was 1944 all over again: what made economic sense for the emerging markets of yesterday continues to make sense for those of today and likely for those of tomorrow.

Just like their predecessors, many of these countries, particularly China and other Asian economies, believe today that keeping undervalued currencies is a key to grow and sustain their exports to the developed markets of the US and Europe and thus to increase domestic wealth. This shows why fixed-rate systems never died out completely. These countries' central banks see a weak currency as a critical element of the country's export-oriented economic policy. But on the other side the inflationary pressures derived from this monetary policy are creating serious problems to their economies.

The US trade deficit grew to unprecedented highs throughout the so-called Bretton Woods II, supported by strong US consumer demand and the rapid industrialization of China and other emerging economies. As of today, the US Dollar is still the most extended reserve currency and the form in which many countries hold US debt instruments.

Clearly, any dramatic moves on the part of the countries that have accumulated large holdings of US Dollar reserves to change the status quo arrangement would have the potential to create turbulence in international capital markets. For instance, the political relationship between the US and China is also a significant part of this equation and of the big picture itself. This has always been a sensitive political topic and of much importance when considering the current monetary system.

Joseph Trevisani writes in one of his market views:

The funds will be borrowed from foreign governments with their own political and economic agendas. For China the logic is clear. China is the world's largest holder of US Treasury securities with $653 billion in their vaults.

Asian economies seem to be willing to perpetuate this status quo because the US consumer has supported the growth of their economy during the last decades. But at this point you are surely raising questions like: What happens if they don't want that debt anymore? Or, what if one or another member of this arrangement concludes that its self-interest lies in abandoning the system? These are certainly questions that belong to a broad analysis and for which you should try to find objective answers.

Joseph Trevisani is one of our contributors. Read all you can from this author to get a clear view of the big picture.

Axel Merk, who shares his insights with us in his regular market outlook, states the following:

To give a little more background as to why the Dollar may indeed become a topic of the G-20 Bretton Woods II meeting, some historic perspective may be in order. In a 2003 analysis entitled Global Warming, we wrote: The most recent experience to a serious Dollar devaluation dates back to 1971 when the US abandoned the gold standard on August 15. There are parallels to the events at the time. When the 1944 gold standard (Bretton Woods agreement) was put in place, the US Dollar quickly became the world's preferred reserve currency, as it was not only the only currency convertible into gold (at $35 an ounce), but - unlike gold - it also paid interest. In the second half of the 1960s, LB Johnson increased government spending in a booming economy with full employment causing major imbalances. LBJ was more interested in re- election than in taming the economy. As a result, more Dollars were printed and foreigners started to exchange their US Dollars for gold. By 1970, only 55% of the US Dollar was backed by gold; by 1971, that ratio had fallen to 22%. To support the Dollar, the German Bundesbank (Buba) purchased US$4bn in April 1971. On May 4, 1971, the Buba purchased US$1bn in 1 day, and on May 5, 1971, the Buba purchased US$1bn in the first hour of trading, after which intervention was given up and currencies were allowed to float freely. A severe devaluation of the Dollar ensued. Similar imbalances have been re-created today, except that the US Dollar is no longer backed by gold and foreigners hold US Treasuries; Asian countries in particular may have little choice, but to sell their holdings as they feel obliged to inject money into their domestic economies.

While this first part of the chapter covers only few aspects of the big picture and leaves some questions in the air, it should encourage you to complete it and build your own version upon which to develop your trading. You also need to create ways to monitor and measure what might be going on in the world. This way you will be flexible to adapt to new conditions if things change (and they do change), and you will understand that while some aspects of the big picture imply a crisis, every crisis can also be seen as an opportunity.