- Advice for monitoring and adjusting a Trading Plan

- Instruments for quantitative and qualitative assessments of trading results

- How to keep feeding your Inventory

- Record keeping mechanisms: the Trade Log, the Trade Journal and the Thought Journal

- A trading team and a mentor as part of your plan

- What does it mean to be accountable to someone

- Many additional tips to treat the plan as a enjoyable work in progress.

Do you really need to have a Trading Plan? No. Does having one increase the chances of success? It depends. What then is the purpose of having a plan? The answer is: to implement it.

This last chapter deals with the practical side of a Trading Plan. For most newcomers, the idea of Trading Plan suggests some kind of written document, where the trading rules are explained and even graphically portrayed. It is only with time that the full dimension of the plan is acknowledged, that is, as something that has no start or end, that is in a continuous process of change. When Trading Plans fail it is not only because of an inadequate design, but also because traders lack the know-how to monitor, assess and adjust it. The idea of a plan has more to do with an attitude than with a dossier lying on a bookshelf.

There is no reason to ever lose a dime of your money while learning to trade. Commitment and perseverance are required to put a well thought-out Trading Plan to work. The plan will be the ultimate test to find out if this business is for you, and, if yes, how you best approach it.

1. Monitor And Adjust As Necessary

The efficacy of your Trading Plan will greatly depend on the periodical monitoring of your performance. There is a tactic employed by some of the best traders in the world to reproduce those actions that lead to winning trades and eliminate those that were contributing to losses. This tactic consists in analyzing their past trades, and looking at which ones were profitable and which ones were not in an attempt to identify similarities in the wins and in the losses.

Success in trading is not based on profits alone, it is based on the ability to sustain profitability over a long period of time. Everyone can have a lucky day, yet as you know, luck will be not your ally in the long term - but probability will. That is the reason you want to know why you had a good trading session, if the profits were the result of luck or skill, and if the trades resulting in a loss were due to a mistake or if they were within the normal statistics of your system.

The goal of continually evaluating your performance is to find out what factors influence the trading performance, weather positively or negatively and then analyze if subsequent adjustments produce better results than in the past.

With proper logging and analyzing habits, any trading strategy can be adjusted to be profitable - it just takes time and discipline to get it to work. It is imperative that you periodically monitor and adjust your performance because no method can work forever. You will not change it every day, but once in a while it needs to be adjusted to new variables, changing market conditions or shifts in the way you understand the market.

Monitoring, adjusting and improving your trading is a continuous process and there are several ways to do so as we shall see.

Detect Areas Of Improvement

It is recommendable that you set apart some time every day/week/month to do your monitoring and decide how will you go about conducting a review of your trading activities and how often you will do this. Start by taking note of your mistakes by asking yourself if a loss was due to a mistake, and if yes, then ask what your thoughts or actions were just before you made the mistake. This will allow you to detect it earlier next time and change your behavior.

Van Tharp speaks on the impact of mistakes can have on your trading:

Taking Steps to Minimize Your Mistakes

What happens when you do not follow your rules? You make a trade when your system did not tell you to trade. You are supposed to get out of a trade when your stop is hit, but you do not get out. Your position sizing is too big on a particular trade. Those are all mistakes – and mistakes can be very costly. We have done some preliminary research on the cost of mistakes and results suggest that for leveraged traders, mistakes can run as high as 4R per mistake. If a person makes ten mistakes in a year, that trader could find profits dropped by about 40R. That means that if he or she made 50% on the year – they could have made nearly 100%. If he or she lost 20%, then mistake free trading could have made that person profitable.You do not have to be perfect to beat the markets, but you have to be slightly better than almost everybody else, and that is hard enough. In order to achieve that, make sure you outline specific steps for improvement. Try to be as specific as you can when describing areas of improvement. A vague generality such as “I need to cut my losses short” or “I need to stick with my plan” is not enough. A better remark would be “I'm unable to cut my losses short because I'm often away from the computer and therefore can't manage the trades properly;” or, “I can't sick to my plan because my goals are not achievable with the type of system I'm using.” These kind of observations are easier to find a solution for. Many times the answer is within the problem.

Quantify Results

Another way to know where to improve your trading is through a statistical record. This is the best way to quantify your mistakes and your abilities. You need to be familiar with your performance statistics. This cannot be over emphasized, so much so in fact that failure to test your set-ups in statistical terms will largely invalidate your Trading Plan and render useless all your work thus far.

Each system carries different statistics like the Profit Ratio, the Drawdown, or the Average Loss just to name a few figures. The only way to become truly familiar with them all is to process your trade results with statistical formulas. Do you know what the probability is of a successful trade with your method? Can you tell what the best risk-reward ratio to cope with that win probability is? Or, have you tested different position sizing formulas with the aim to maximize your performance? Providing answers to these and similar questions can be only made if there is a thorough method of recording the trade results as well as an extensive period of time accumulating these results for a specific system or trading model.

Every time a change is made to your rules, test them before applying. You really have to believe that your trading method has and most likely will generate profits because otherwise after a series of losses you might abandon the whole plan. You need to have a lot of confidence in your strategy, which you can get by quantifying your results. Statistics are the best vehicle to do measure this quantitative aspect. Now we are going to see that confidence in your abilities as a trader is gathered by qualifying your performance.

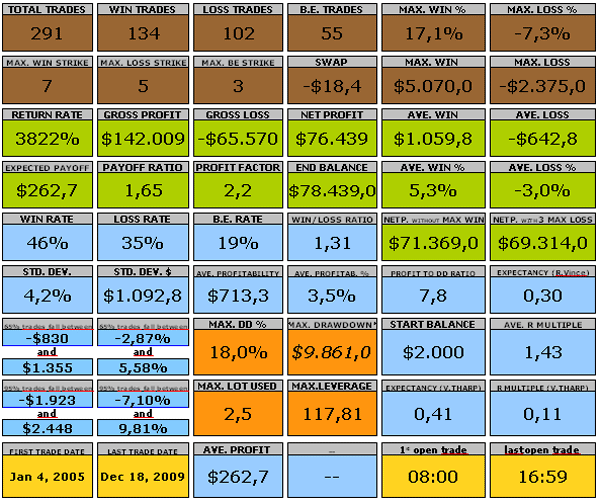

The picture below shows the statistical figures of a backtest trading the system disclosed in Chapter 01 during the years 2005 and 2009 in the GBP/USD. The file is available in the Practice Chapter C.

Qualify Results

Some aspects of your trading performance can not be tracked with statistics because they are qualitative in nature, but they still need to be judged whether they meet certain criteria. To cope with this, we have listed below some evaluation questions:

- Did you take the entry/exit signals according to the checklist?

- Was the execution correct? If not, identify the problem (the platform, the price feed, your speed of reaction, etc.)

- Are you managing your planned trades more by feel than by plan? If yes, you might be expressing through your behavior a lack of confidence in the plan.

- What part of the Trading Plan do you lack confidence in?

- Are you trying to trade a longer time frame when your cognitive skills and style better are better suited for a shorter one?

- Are you using impulsive criteria or new variables which are not in the trading checklist (see previous Chapter C03)? What are these criteria and will you change the checklist to embrace them?

- Are you trying to trade someone else's system without having researched or tested it extensively yourself?

- Did you calculate the position size accordingly to your money management rules? If not, why did you trade a smaller or bigger size?

- Could you have stayed in longer or did you have your profit target as planned? If you closed too early, what variable or motive led you to do so?

- How was your attitude and what emotions did you feel before, during and after the trade?

- Did you feel comfortable with the length of the trade?

- Are you ready for the next trade? If not, is the trade frequency too high, or are you exhausted due to the amount of hours spent in front of the screen?

- What were the best trades and what were the characteristics of those good trades?

- What trades do you consider the worst and why?

- Have you checked your performance results with your accountability partner?

- Are your monetary goals being achieved? If not, should they be reconsidered?

The answers to these types of questions should be directly compared to the Trading Plan in its several components (monetary goals, money management, risk control, system rules, etc.). By doing so, every trade will be evaluated in an objective manner.

Moreover, they will outline how you approach the market and also how you approach yourself —moreover, they will allow you to review each trading journey and see if you are on the right track. Such a qualitative review is an essential step in the kind of continuous improvement that marks winners across all disciplines, not just in trading.

A Worst-Case Contingency Plan

- How will you know if one of the pieces of your strategy stops working?

- After identifying that one of the pieces of your strategy has stopped working what will you do to address it?

- What happens if you keep losing money and a new Maximum Drawdown is reached?

Because the market is perpetually shifting, having clear-cut strategies that match your personality is important. But even so, changes may occur in market conditions or in the way you trade, making your results deviate from the norm. These changes should always be detected by a trader who tracks his or her performance before they cause too much damage. The above questions address those scenarios when series of losses represent a menace to your success.

Drawdowns will be part of trading no matter what strategies or type of trading you plan to implement. Therefore, you want to have mechanisms in place to detect early enough that something is going wrong. Statistics and a close follow-up of your executory abilities are thus primordial control mechanisms. But what happens if you keep losing money despite your control mechanisms? A contingency plan must be in place when new Maximum Drawdowns arrives.

Just knowing what your historical Maximum Drawdown level is, you can determine when you should stop trading a strategy. For example, if the trading equity suffers, let's say a 30% loss, then you stop trading the system to either reevaluate it or to discard the system altogether. This stop out level is something that is decided in advance and is based on historical results. Maybe your current position sizes make the equity fluctuate a lot, and a 30% Drawdown is absolute OK and will most likely be recovered within a short time. But how do you know if this is so if you do not have any statistical evidence to indicate it?

If a Drawdown burns a significant amount of your equity, you need to identify whether or not it was the strategy, the position size, or the failure to execute the trading system. If the last cause was the problem, then adjustments to your behavior or trading environment have to be met. If, on the other hand, it was the strategy or the position sizing, then it may be time to determine if these components need some improvement or adjustment.

The question of what level you stop trading at has also to do with your own financial situation. Are you prepared to lose the entire allocated trading capital before you are forced to stop, or do you prefer to hold on to some of the money and commit it somewhere else?

Bottom line is: a worst-case contingency plan is needed so that you can be prepared for anything major that could upset your trading business.

Keep Feeding Your Inventory

Your inventory acts like the backbone of your Trading Plan. It condensates the beliefs your are holding, as well as new adopted beliefs and discoveries about market reality. You can always remove ideas and observations from the inventory to create a new strategy or modify an existing one. In this sense, it is also the quarry where you get your raw concepts from.

The way you see and experiment the market can undergo profound changes up to the point that a trader may completely reorient his/her whole trading approach. Meaning, a trader may go from a trend follower to a counter-trend style. But subtle changes are also possible (acquisition of new tools, setting new parameters, etc.) and also quite frequent.

The best way to keep an Inventory is having a written list always on hand or a blog where you post your statements periodically so others can be inspired by them. An Inventory, which is a requirement for successful trading, is something different from a mere system of rules or a list of “do's” and “don'ts”. It is a constellation of ideas, beliefs and things you have heard about and can identify with and observations about anything related to the trading activity.

A statement belonging to the Inventory list would look like this:

- 75% of the weeks, I observe that the exchange rate tends to retrace back to the weekly pivot.

Whereas a statement to write in a Trading Journal would look like this:

- The RSI cross below the 70% level that I use as a trigger didn't work well this week.

Source: Flickr

If you add a new statement to the Inventory following the conclusion of each unsuccessful trade, you will end up with a long list. This means if you need to get specific about your system's rules, there is a better place to track your notes on a trade-by-trade fashion: the Trading Journal. This is the topic of the next section.