2. Record Keeping

The trading session has finished, now it is time for reflection and to review your trades. Depending on your trading frequency, it may be more or less time consuming, but the point is that you take the time to understand what went right and wrong during your trading journey so that analyzing that data performance can be optimized.

The Trade Log

All information regarding the execution of trades goes in the Trading Log. Later, when this data is processed into statistical figures and graphics, it will speak about the performance of the trader or system under the current market conditions. Logging your trades is time consuming and is a less glorious part of trading, but if you don’t keep track of them you will never be able to accurately determine if you have the ability to improve your trading performance. The way your systems operate can be adjusted with these findings in order to achieve better results with your trade timing, position sizing or risk control. It is especially tedious in the beginning when more discipline is required, but with time it becomes an habit.

There are several items that are important to keep track of in a useful trading log:

- The currency pair traded

- The time you entered the trade

- The price you entered the trade

- Initial Stop Loss price

- The Risk to Reward Ratio (R)

- The time you exited the trade

- The price you exited the trade

- The direction of the trade (long or short)

- Amount of Pips made

- Profit or loss amount

- Position size traded

- Swap (rollover)

- Comments: was there slippage, news announcements, a holiday, etc.

The above data will allow you to calculate other data like:

- Duration of the trades

- Which market session accounts for more trades

- Percentages of winning and losing trades

- Number of long trades vs. short trades

- Etc.

The Log provides critical data on where and how money is being lost or made. If trades are randomly made, for example, or deviate from one another in a significant way, it immediately becomes evident when looking at the equity curve or at the standard deviation of the results. There is a quite substantial number of statistical figures as seen in Chapter C02.

The most effective method for logging your trades is by means of a simple spreadsheet - by entering the data into the fields you create. It is worth keeping a complete and accurate log. It provides a helpful overall picture to improve upon.

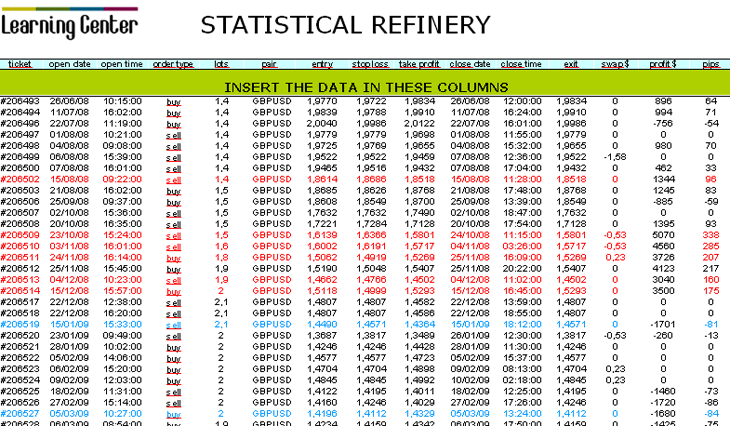

Make sure the Trade Log includes performance metrics like the ones shown in the picture below.

The image above is taken from the spreadsheet attached to Practice Chapter C. This chapter contains, in addition to a multimedia backtesting series and a 250-question practice exam, a spreadsheet with dozes of statistical formulas and many charts to help you log and interpret your trades. The spreadsheet will help you analyze data by generating detailed reports and graphs.

Armed with statistical knowledge, a trader might gain additional confidence in his or her trading model and might even trade it more aggressively. When testing certain money management techniques, it becomes clear that in order to calculate the position size variables are needed which can be only found in historical data.

Conversely, a trader might need to know when the trading method has been, statistically speaking, performing poorly in order to reduce the trade size under certain market conditions and avoid a massive Drawdown on the equity.

The benefits of a trade log do not end here: if your ultimate goal is to persuade investors and manage their capital, this is a way to differentiate yourself from many others because this kind of information on statistical performance and reasons why and when you change your strategies are very important for the investor.

The Trading Journal

Documenting your trading is of vital importance to tracking your trades not only in terms of "mechanical" data (entry, targets, stops, exits, etc.), but also in terms of the "internal" data as well, that is, the thoughts, emotions and other observations that accompany each move.

Keeping a journal is one of those tasks which belongs to the trading practice. Like in sports or other high-achieving areas, it is not at all unusual to spend far more time training than actually participating in the activity.

It is recommended that the journal comprises the specifics you need to accurately assess what you are doing well and what needs improvement. For professional traders, trading is a business and that is why the journal is part of the Trading (business) Plan.

This means that any detail of your trading decisions, including reasons for initiating, managing and closing a trade as well as notes concerning price action and market behavior, should be part of your Trading Journal. Although it is a time-intensive process, you will be astonished how the methodical way of maintaining a Trading Journal will give you a clearer focus.

Looking in the rear-view mirror makes you aware of the path behind you have taken and enables you to improve your future steps. The more information you can pack into the journal, the better. But more importantly, be sure to put it in a way so that you can qualify the trades later on. Once you have a matrix in place of all of these different factors in your journal, you will see how quickly your weaknesses and strengths jump out at you.

Below is a sample list of points that you can easily duplicate for yourself. Feel free to add more points to it. If you prefer, a more detailed version is found in the Practice Chapter D.

- Arguments why you entered the trade

- Arguments why you exited the trade

- Description of price action and market behavior during the trade's lifespan

- The money management parameters: position sizing, risk control, management of the trade

- Did you do0 anything wrong on that particular journey?

- Any other thoughts that you had while trading should be noted, for instance:

- Do I tend to make money in a particular time of the day or day of the week?

- Is there any pair you lose more money on than others?

- What price action pattern are you trading best lately?

A bunch of conclusions can be reached by keeping a journal of your activity on a regular basis. For example, you may be surprised to find out your pullback trades work out 80% of the time while your breakout trades only work 20% of the time. Or that every time you trade the GBP/JPY you lose money. In this way, your improvement will be systematical and no longer the result of chance.

Wayne McDonell narrates his experience of keeping a trading journal. It is really interesting how the journal became his judge and jury. Read below:

[...]

I really needed this experience as well. I needed to get past my lousy feel for the market. I needed more control, and I achieved this by planning my trades. Then, by reviewing my trades, I learned from each of my wins and each of my losses.

The trade journal then became a check and balance. I found that if I wasn't certain about the trade setup, I didn't make the trade because I didn't want to have it put it into my trade journal. It was like looking over my own shoulder.

The judge and jury for my trades became my journal.

[...]

I would be too embarrassed to enter a bad trade into my trade journal when I thought it had the potential to be bad. Because I entered all my trades into a journal, good or bad, I decided not to take the iffy trades.

From the above quote, it seems like the journal is especially powerful when you tend to violate your system, as all traders are likely to do at some point. A Trading Journal is much more than a routine of documenting and reviewing past trades. It is a strong psychological resource to give you more control over your performance.

Keep A Printed Record

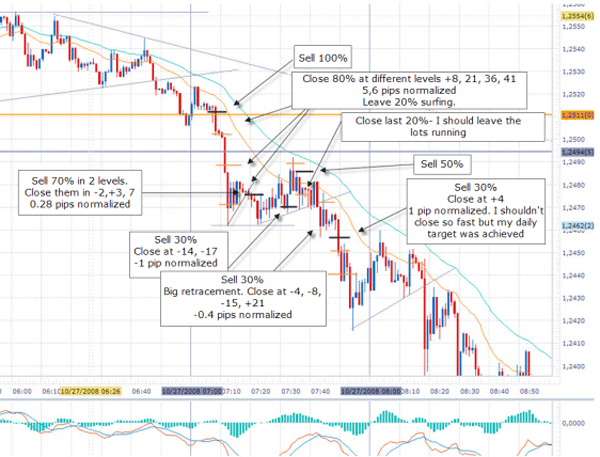

Many traders attach a chart of their analysis and trade management to help them remember the trades when they review their trading journal.

Trading is in many aspects a very visual activity, specially in its analytical and the strategic components. Therefore, keeping a printed record is one of the best educational resources a trader can develop.

This can be done simply by printing out a chart and marking the strategic preparation of the trade and the key decision points. Relevant comments can be also be added to the chart. David Aranzabal is one of the best exponents in following up his trading activity on the charts. The image below illustrates the level of detail of his printed record.

The Best Of

The secret is not only to record your mistakes but also to isolate objectively what you did best – what set-ups, routines, even extra trading activities which positively impact your performance. The journal is not only a means of self-criticism; it is also a tool used to model your successful elements. Record your best trades with printed charts and review them regularly. This way you train your subconscious to detect those particular price patterns that you trade so well.

The idea is not only to have a means of discovering the trader within you, but also to make you excel. In fact, that is how you excel not only in trading but in anything in life.

Trading is relatively easy, but learning how to do it, well, that is hard work ... damn hard. Just ignore it if anyone tries to lead you to believe otherwise. But this hard work can be highly rewarding - and not only in terms of monetary gains. The satisfaction you get with the fulfillment of your Trading Plan is simply priceless.

The Thought Journal

A Thought Journal is that part of the Trading Journal designed to reveal destructive and constructive thought patterns. This same line of thought is found in Woody Johnson' articles:

This is like a log of your emotions and behaviors. The best time time to record your thoughts is during trading, or shortly thereafter, while the emotions are still fresh. As for what aspects to mention, it is less important than trying to record those which are meaningful enough to provide ways of improvement when reviewing them.

In order to detect persistent and destructive behavioral patterns, we suggest you replicate certain questions of the Though Journal in the Checklist (see previous Chapter D03) so you can track the emotional involvement during the trading process. The Checklist and the Trade Journal act as two separate and independent emotional management tools, but as parts of the same Trading Plan, some elements are present on both.

These are some sample questions to include in the Thought Journal. Take note that questioning yourself is the first step to awareness and change.

- Do you notice a lack of a more clearly defined Trading Plan?

- Is the need to make more money putting too much pressure on your performance?

- Are there any environmental distractions affecting your trade execution?

- Do you feel tired or mentally overloaded because of the adopted trading style?

- What is the attitude of your internal dialogue while trading?

- Does your trading business lack quality control?

- Are you having fun trading even when it is hard work?

- Does a string of winning trades makes you overconfident?

- Do you notice any unwillingness to accept losses?

- Are you losing confidence in your strategies or systems?

- Are impulsive behavior patterns out of your control?

- Are you victim of “revenge trading” after a series of losses?

- Is the adopted trading style not in sync with some of your personality traits?

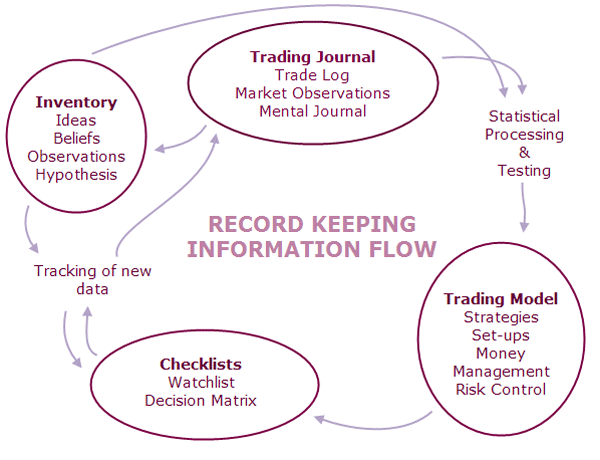

The above diagram shows the information flow between the different elements of the record keeping activity. For example, the statistically processed Trade Log data serves to adjust the trading system, which then goes to the Decision Matrix once properly tested. The new implemented rules are finally reflected in the Trading Journal again.