- General guidelines of what a Trading Plan is and how to put one together.

- How to crystallize your plan with a complete list of components or enhance what you already have.

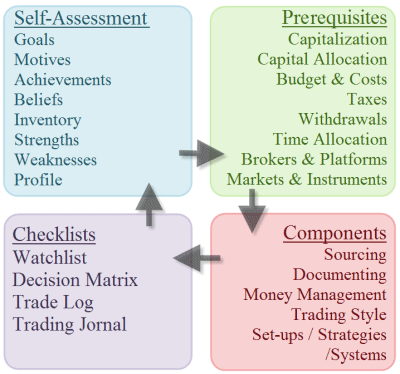

- Key areas to perform a self-assessment.

- Learning the psychological benefits behind a Trading Plan and key aspects to designing a Plan.

- Learning to build checklists for each area of the trading business.

Would you like to win regularly and have the confidence that you are better off than most people that take up trading for a living? If we go through Forex educational materials on the internet, we find most of them transmit a notion of how easy it is to trade. This, together with advertizing the potential of big gains, is what attracts most novices to start trading in the first place. These notions have the reverse effect on most novices because they simply aren’t prepared to face the markets and have no idea what to expect. When starting out, we rarely see the dimension of what has to be done to succeed in this industry.

A Trading Plan is not something to be implemented in a later stage of your career- it is something you need right from the beginning. It is now when you need to ask yourself whether you are prepared to work towards achieving a Trading Plan that will work. If your answer is yes, then we have a deal!

All consistently profitable traders have a plan and follow it with the sufficient level of confidence. If it were not for your step-by-step preparation provided by the Learning Center, you could become overwhelmed with the task of building a personal Trading Plan. But now has come the moment to take full advantage of many of the topics covered throughout the previous chapters and implement them into a coherent and well structured plan.

Right at the very start we will see the general requirements of a Trading Plan and understand why they are necessary.

The second section will cover a number of questions relative to motives, goals and expectations.

Then we will start to lay out the components of the plan in section three and four. Imagine there is an investor searching for a trader to manage 100K for him. Could you provide the investor a solid outline of your methodology and explain why that methodology will be profitable and how you are going to achieve the desired results? Let's face it: would you be able to convince him with what you've got now?

We believe the whole purpose of the trading plan is to keep you in the game. It is not about creating a masterpiece that gathers dust on a shelf. To be able to last in this business, you are going to have to focus on improving your skills each and every day and focus on your trading goals years in advance. This is the aim of section five, which is about creating healthy habits and designing a well-balanced trading routine.

The bottom line is that trading success will not happen overnight and you would do yourself a favor not believing someone who tells you so. Anything that is worth achieving takes time and your educational path should be one of constant and gradual improvement. This chapter takes you through, step by step, how to write an actionable, achievable and profitable plan - a plan that makes your trading more consistent than than it is right now.

1. General Guidelines

What Is A Trading Plan?

Sadly, a lot of people who start trading find success difficult to achieve. One wonders what the minority is doing differently that gives them the advantage over the vast majority who leave the market with less money than what they had when they started. Do they have better strategies and systems? Is it because they have better equipment and resources? Or does it depend on the IQ level of the trader with success reserved for brilliant minds only? We believe the reason that many traders walk away with less money than they had to begin with is because they lack a plan.

You will surely come to realize that building a plan is going to take a lot of effort. In this chapter and in the following one, you will be handed a large list of elements and guidelines a profitable trader uses and follows. Obviously, the image we have of how a profitable trader works is a synthesis of what we have come to realize as the ideal characteristics of a perfect trader. And even though no trader in reality is perfect, guided by that image, we hopefully can help you work towards developing positive trading habits and have a more positive experience after all.

Basically, what you will be asked to do is to put all your focus and energy into doing things that most of the other retail traders never do. These things are, for example, keeping a journal, having a check list, questioning many of your beliefs and continuing to specialize and research, just to mention a few. Besides a great deal of energy, all these tasks require discipline, patience and awareness.

Why Is It So Important?

Having a trading plan facilitates your decision making by helping reduce the influence of your emotions and, therefore, allows you to trade more objectively. Objectivity becomes altered when one trades because there is money at stake, specially in pressure-filled situations.

A plan not only keeps you focused and aware, but it can also motivate you to achieve. It is a commitment with yourself and a road map to define your objectives.

By providing a framework to operate, it also assists in internalizing market action- you become more specialized in what you do and the way you trade. Besides, a plan is a means of adjusting and fine-tuning your trading as well as something to measure yourself by.

Don Dawson refers to the importance of having a plan even for those who are starting small:

It Must Suit You

A good Trading Plan is a lot more than just a list of instructions that you have written down for yourself. The best traders have discovered an approach that they are very comfortable with and confident in; however, most importantly the plan perfectly suited them as individuals. Traders not only need methods that possess a reliable edge; they need those methods to fit who they are.

A risk-averse person, for instance, won't follow an aggressive system of pyramiding into positions. Most people have a different tolerance to risk and since managing risk is a vital part of trading we want to know what our level of comfort and confidence in relation to risk is.

But how can you possibly develop an approach that suits your personality and conditions if you really don’t know yourself? That is why the first part of assembling your trading plan should be to conduct a self-assessment. Some of the more important factors include your personality traits like patience, confidence, decisiveness, emotional stability, mental agility and, probably most importantly, your attitude towards money.

Besides your tolerance to risk, a good trading plan also contemplates many other factors including even seemingly unimportant things like how much time you have to commit to your trading, your goals and expectations, and also the conditions of your working environment.

When traders attempt to make money in ways that don't genuinely exploit their strengths or that neglect their weaknesses, they often abandon their plans because those plans don't truly fit who they are. Boris Schlossberg explains in his book:

Also the goals that you establish should be things that you can achieve. There is a difference between what's possible to attain by trading the markets, and what you really can do. Doubling the account in 3 months is a possibility, but will you be able to do it with your current level of expertise or under your present conditions? Avoid putting things in your plan that your mind does not conceive of as a probability because this will only cause friction and the entire way will be a battle with yourself. Try to be honest from the beginning and include only those goals that fall in line with your inner beliefs. Honesty with oneself can be painful in the short run, but reinforce your goals in the long run.

Keep It Simple

Another key characteristic of a Trading Plan is the ease in which you can execute it. Simple approaches have proven over time to work. In the context of building a trading strategy, Don Dawson explains:

Moreover, the Trading Plan shouldn't be overwhelming. Avoid picturing your trading plan as a detailed document containing dozens of pages because then it may deter you from compiling one in the first place. The reason we suggest to structure the plan into several parts is to make it more viable. There are parts of the plan relative to macro aspects which only need to be checked a few times a year, while other parts are more concerned with the day to day execution- the micro level- and need a closer monitoring.

Keeping the plan simple in the macro level is, for instance, key to avoiding making unrealistic expectations, which is one of the reasons why people become disappointed and fail to follow a plan.

On the other hand, keeping the plan simple on a micro level helps novices against the tendency they have to populate charts with a myriad of technical indicators when they realize that trading is not as easy as they thought it would be.

Specialize- You Can Not Learn Everything

We have seen quite many ways to make money trading Forex; and we have seen also the other side of the coin: there are ways to lose money as well. One sure way to lose is to skip from strategy to strategy, never persisting long enough to master one. There are so many possible ways to trade the markets, you can get easily lost trying to find one.

A completely different result is achieved when your approach is one of learning, testing, practicing and mastering just one trading method. Not only your account but also your brain cells and nerves will be thankful if you don't fritter them away by constantly changing tools and methods. Design one method accordingly to the parameters of a personal plan and then commit to it. Soon you will reap its benefits: you gain massive clarity and focus about where you want to spend your time and energy.

Specializing means also refining your approach and getting into the realm of intuition- your trading will resemble more like an art. This topic will be covered at the end of the next chapter.

Conceptualize Your Methodology

Consistent profits in trading do not respond to technical knowledge only. They come from a particular understanding why the markets behave in the ways they do. When you start conceptualizing market behavior and establishing certain hypothesis, you are in fact building a particular theory of the market. This is what we have done in Chapter C01 when building a trading system. The observation of price action leads the trader to formulate certain reflexions. Below are some reflexions as a means of example. Note that your personal inventory can be totally different:

- There are certain price levels where most traders enter positions more based on emotion than on technicals or fundamentals, and I want to profit from their mistakes;

- When Pivot Points and Fibonacci Extensions coincide at the same price level, this area becomes a major decision point. Add a third technical confluence and the price level becomes even more decisive;

- When the exchange rate leaves a price range very fast, very often it comes back to pick orders left at that level. This happens in all time frames, even on the one minute charts;

- By testing several 100% technicals systems, I noticed that Drawdowns are quite severe- making me think that either a discretionary approach may be more adaptable to changing market conditions, or a combination of several mechanical systems designed for different market conditions;

- In all pairs, the exchange rate never spends much time without touching the weekly Pivot Point. What is more, I noticed that the best liquidity is when prices return to equilibrium points (Pivot Points is a mean, that is an equilibrium point), not when they diverge from it;

- By testing the same trading system with different money management techniques, I noticed that the results can differ a great deal (the Win Rate of a modest trading system can be much higher if a certain technique is applied);

- There are always a continual flow of new participants into the Forex market, and they are generally ignorant of the way the exchange rates have behaved in the past. From my point of view, the same mistakes are often repeated by novices, and this explains why price action is repetitive in its behavior. I want to exploit their movements by trading counter intuitively.

Don't delay this task further, if you don't have such an inventory, start writing one today. As you probably notice, the inventory list contains technical elements but also other observations on pure price action. But you can include fundamentals or any other theory as long as it makes sense to you. The list has neither to be static nor definitive - you will be adding, cutting and modifying along the way.

Once you have your inventory in place, write down in very general terms how you are going to approach your trades; how will you capitalize on certain repeating patterns that your particular view of the market explains. Here is where you start to postulate certain hypothesis, for example:

- Most of the days price breaks the high and/or low of the previous day- therefore I want to capture part of that breakout movement;

- When the Fibonacci extension of 161.8% is at the same price level than any of the support and resistance levels of the daily Pivot Points, the breakout in price is likely to reach that level.

This way, each trader builds a trading method that reflects his or her particular theory of the market. This particular theory, or view, can be entirely based on personal observations or initially by borrowing ideas from other traders. Be careful when relying completely on methods which are not developed by yourself because if you do not understand their underlying principles, the whole process will be one of mimic. Besides, you will have a hard time when the method appears to stop working. How will you know if it was the market conditions which have changed or if it is you who has changed?