2. Risk Control Measures

Risk is the possibility of loss. Although there are many types risks (sector risk, risk of a broker-dealer's insolvency, etc.), the risk we are going to consider is the possibility of the market to go against us. As long as a position is held in the market, there is a risk. In the matter of trading currencies and aiming for profit, risk is fundamentally unavoidable and the best we can do is to manage it.

In Chapter C01 we have talked briefly about stops as elements of a clear exit strategy governing losses. In this section we are covering stops from the perspective of risk management. The adopted logic is perhaps a little bit divergent, but as a trader you should always be concerned with what you can afford to lose before you consider the potential gain of a trade.

Stop Losses

There should be only two main reasons for stopping out of a trade: the market tells us that our intrinsic view was wrong, or we think we can establish another position at a better level than the previous one.

In both cases stops serve to preserve capital from the inevitable losses so that more capital is available to exploit the winning trades.

Stops Defined By Technicals

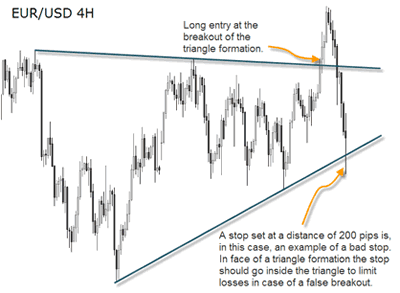

An example of a good technical stop is one that protects the position and allows profits to accumulate, and a bad one is one that will prematurely liquidate positions by being too tight or expose the trade to excessive risk.

In preparing an exit, always recall a valuable rule for optimal technical analysis: entry your trade where price must move only a short distance to prove that you are wrong.

Technical analysis can generate thousands of possible stops, driven by the price action, by various technical indicator signals or volatility. Technically oriented traders usually combine these exit points with equity stop rules to formulate charts stops. We shall see later how this is done.

How to place stops and risk control is taught by James Chen in this recorded webinar: Managing Risk to Target Consistent Profitability in the Forex Market.

Fixed Dollar Or Pip Amount Stop

The fixed dollar, also referred to as an “equity stop”, is the simplest of all stops. The trader risks only a predetermined amount of his or her account on a single trade. A common metric is to risk 2% of the account on any given trade. On a hypothetical 10,000 US Dollar trading account, a trader could risk 200 US Dollars, or about 200 pips, trading one mini lot, or 20 pips with a standard lot.

Using a fixed pip amount the risked dollar amount would vary a little bit since the pip values are different for each pair.

One strong criticism these kind of stops get is that, from a technical point of view, they place an arbitrary exit point on a chart. The trade is liquidated not as a result of a technical response to the price action or technical indicators, but rather to satisfy the predetermined risk control rule.

Margin Stop

This is perhaps the most unorthodox of all uses of stop loss orders, but it can be an effective method in Forex, specially for very aggressive trading methodologies and traders with a high risk tolerance.

Risk management is important whatever the traded instrument but especially for anyone using margined products such as the Forex. Trading on margin opens up the possibility of greater potential profits but at the risk of larger losses. With some leveraged instruments, potential losses are not restricted to the cash committed to the margin account, instead additional capital calls can be made if large losses are incurred.

In Forex this cannot happen and clients cannot lose any more money than they have deposited as a margin. Forex broker-dealers automatically liquidate their customer positions almost as soon as they trigger a margin call. For this reason, Forex costumers are rarely in danger of generating a negative balance in their account.

That being said, the use of margin stops requires the trader to subdivide his or her trading capital into several parts and only fund the trading account with a fraction of the speculative capital. A trader with 10,000 US Dollar, for instance, would open an account with 1,000 instead of 10,000, leaving the other 9,000 in the bank account.

Most Forex boker-dealers offer very high leverage, so a 1k deposit would allow the trader to control a bigger amount of capital. However, and this is the dangerous part of this method, even a few pips move against the trader would trigger a severe loss or even a margin call.

Regardless of how much leverage the trader assumes, this controlled parsing of his or her speculative capital would prevent the trader from blowing up the trading capital in a string of bad trades. At the same time, it would allow the trader to take advantage of a potentially profitable strategy without the worry or care of setting fixed stop loss orders. This leads us to the next point.

Mental Stops or Automatic Stops?

Mental Stops are levels or regions where the trader intends to cut the loss on a position. They differ from automatic stops in the sense that they allow you to watch the price action around the stop level or region and to remain in the trade if the market moves back into the direction of your trade.

Despite the automatic stops, it can still be very difficult to take a loss. Traders should use stops but they need to do so in a disciplined way. Some people really struggle to accept losses and will actually move the stops down out of the way to avoid materializing the loss!

The common advice is to decide on a stop loss before entering into a trade and to place a stop loss order along the trade. This compels the trader to have an exit plan for every trade. We have seen thattrades tend to go wrong more often than we would like. Therefore, the use of mental stops should not be seen as improvisation but merely a matter of execution. Mental or automatic , the risk amount should be defined before entering the market.

People who disagree with the use of automatic stops sometimes fail to realize that they are in fact using a stop – it just happens to be their entire account, or all the money they are willing to fund an account with. They are using margin stops!

Besides, leverage is something most beginners will try to take advantage of and using no stops with leverage is a dangerous weapon.

You need to have a big account to allow you to trade without stops or your gearing needs to be very low.

Moreover, not all participants come to the party armed with well capitalized accounts, neither will they possess the necessary psychological strength or trading experience to allow them the luxury of executing positions without stops.

Let's see some advantages and disadvantages of mental stops:

Pros:

- If we have chosen our stops levels correctly, and the risk is not excessive, it is quite likely that the market will give us time to determine whether our position is worth retaining or not. Mental Stops can be used effectively for that propose.

Cons:

- One downside of mental stops is the difficulty of watching positions while we are away from the trading desk.

- The use of mental stops requires you to be honest with yourself and cut the losses if you see the price action around the stop level-region. In the case of automatic stops, the trader may pass the responsibility of his positions onto the market by saying "The market took me out". When using mental stops, you have to exit the market when the market is telling you to exit so you carry the responsibility and the tension of watching and managing your position.

- There are other instances when automatic stops are more efficient than mental ones. It will ultimately depends on the system you have developed. But if you trade, for example, with pattern formations or indicators that usually provide clear and well-defined Risk-to-Reward trade set-ups, having a mental stop in this case would be wrong: if the formation (or indicator) proves to be wrong, the market may slice through the mental stop region, giving you no time to react.

Mental stops call for greater maturity and finesse than automatic stops. Mental stops in the wrong hands is a very dangerous weapon. For instance, some currency pairs can sprint 200-300 pips in the blink of an eye, and an inexperienced trader who tries to replicate such a method without the required mindset and/or experience will very quickly learn some extremely harsh lessons.

Learn about types of risks, threats and errors that affect traders in an article written by Lance Beggs in The Trader's Journal: “Minimizing trading risk through proactive threat and error management”.

To summarize, while it's important to see stops as a measure of risk control, it's different than controlling the risk by sizing the position or even managing an open position. Many people believe that knowing where to place protective stops constitutes money management, perhaps because of lack of information or unwillingness to delve into issues related to managing risk.

Although stops are an indispensable tool to protect our capital, the placement of stops is just a part of risk management. If a trader applies, for example, a stop loss of 200 pips on each of his positions he is pursuing a strategy that is absolutely not related to his total available capital or equity: you can not categorize that measure as money management.