2. Measuring The Trade

The Spread

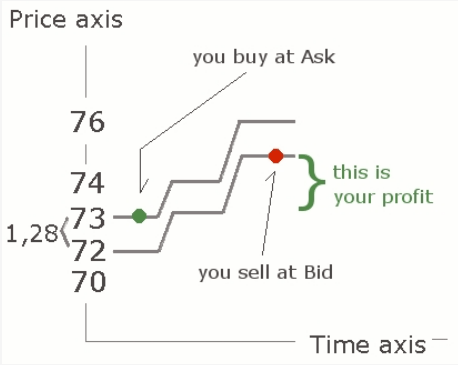

As with other financial instruments, there is a price an investor can sell at which is called "bid" price, and a price the investor can buy at which is called "ask" price.

From the broker-dealers' perspective, the bid is the price at which the broker-dealer is prepared to buy, therefore to "bid" a specific currency pair from you as a trader. At this price, you can sell the base currency to the broker-dealer.

For example, in the quote EUR/USD 1.2872/73, the bid price is 1.2872. This means you sell one Euro for 1.2872 US Dollars.

In turn, the ask is the price at which the broker-dealer is prepared to sell (is "asking" for) you a specific currency pair. At this price, you can buy the base currency. It is shown at the right side of the quotation. Sometimes it's also called the "offer" price.

Using the same EUR/USD quote, the ask price is 1.2873. This means you can buy one EUR for 1.2873 US Dollars. The ask price is also called the offer price.

The difference between both prices is known as the "bid-offer spread" or "the spread", and it's expressed with a similar quote convention than the pair:

In our example, the spread value would be of 1 point, the difference between 1,2873 (the price the broker-dealer is ready to sell) and 1,2872 (the price the broker-dealer is ready to buy at).

So to summarize:

Another example illustrates that the bid price of the AUDUSD pair is 0,6520 USD and the offer price is 0.6528 USD:

The critical characteristic of the bid/ask spread is that it is also the transaction cost for a round-turn trade.

The formula for calculating the transaction cost is:

The spread in this case is made of 8 points, also called "pips".

The "big figure quote" is the interbank expression referring to the first few digits of an exchange rate. Sometimes you see these digits being omitted in certain dealer quotes. For example, the above AUD/USD rate would be shown without the first three digits, as "20/28".

The spread is usually lower in the majors, since a high turnover assures ample liquidity to meet the trading needs. That is why interbank and retail dealers charge less for the majors through the spread. For less traded pairs or cross currency pairs the spread will be bigger, since at an interbank level these trades may involve the use of synthetic pairing and dealers have to assume more risk in completing those transactions.

If you intend to trade very short-term, i.e. with a tiny time horizon for each round turn trade, you will face a disadvantage in terms of trading costs because you will have to overcome the spread more often. This is the case of the so-called scalpers.

To sum up 1000 pips trading the EUR/USD, a medium or long-term trader can make one or two trades that move that amount of pips. Assuming an average spread of 2 pips, the trader has to make 2 or 4 pips to overcome the spread.

To reach the same amount of pips with a scalping method, let's say with 50 round turns, and assuming the same average spread on the EUR/USD, the cost will be of 100 pips (50 trades x 2 pip-spread). In terms of costs that's a lot of pips less effective than a long-term trader!

The spread can be considered an opponent when trading, and pairs with larger market spreads are suited for long term trading strategies. Think that before being profitable, any trade has to overcome the spread first- which is easier to achieve with narrow spread pairs.

Following the spread discussion we started in the previous chapter about fixed and variable spreads, Hans Nilsson adds some interesting points in his article "Quiet versus Volatile Markets, What Kind of Trader are You?"

Variable spreads may be more suited to long-term traders who do not trade during news events and are prone to entering and exiting during quiet market conditions. This way they can more consistently obtain a price that is in the lower range of the variable spread. For example, if a trader were to enter the market during off-peak times with a variable spread of 1 or 1.5 pips on EUR/USD as opposed to the fixed 2 or 3 pip spread on many platforms, he would save money on the spread in the long run.

- 100 trades at 1 pip (or 1.5 pips) = $100 ($150) in spreads

- 100 trades at 2 pips (or 3 pips) = $200 ($300) in spreads

However, flat markets and off-peak times are periods of consolidation when it is less clear where the price will head next. Most traders prefer to place positions when a clearer direction is evident in the market.

During swift market activity, especially around important fundamental releases such as a speech by a central bank official or the opening of local business hours and stock exchanges, spreads are widened to the upper part of their ranges. Likewise, during breaks of key technical levels, the market may also be very volatile sometimes moving as much as 100 pips in as little as 5 minutes. During these vulnerable times, opening positions become more expensive, which can be a deterrent to trading.

Consider this example: A trader prefers to enter and exit the market more when it is reacting to key news and events. He opens 100 positions of EUR/USD; he places 20 trades at a spread of 1.5 pips, 20 at 2 pips, and 30 each at 5 and 8 pips, when the spread has widened to the upper part of its range.

- 20 trades at 1.5 pips = $30 in spreads

- 20 trades at 2 pips = $40 in spreads

- 30 trades at 5 pips = $150 in spreads

- 30 trades at 8 pips = $240 in spreads

- 100 trades at avg. (4.6 pips) = $460

- All together the 100 trades cost $460.

- 100 trades at fixed 2 pips = $200 in spreads.

With a fixed spread those same trades would have amounted to a cost savings of $260. This is a very simple case, but highlights the point that it depends a lot on the kind of trader you are and if you prefer trading during busy fast moving markets or times when the market is calmer.

Variable spreads may even set off protective stops and limits unwittingly. If the difference between the Bid and Ask widens and reaches the level of a stop or limit, this large gap may suddenly execute a conditional order. This adds an extra variable to your strategy that you need to consider. This might be less likely to occur with fixed spreads because the Bid and Ask are always synchronized. Fixed spreads minimize the element of surprise; traders know exactly what the parameters are at all times, allowing for better strategic planning and money management.

The PIP

In equities or futures, the smallest unit of measurement is called "tick" or "point". In Forex this unit is called a "pip" (for Percentage In Point). As shown in the most trading platforms a pip is the 4th decimal place after the comma or, which is the same, the ten-thousandths place in the quoted exchange rate (0.0001).

A well known exception is any currency pair that contains the Japanese Yen where a pip is the 2nd decimal after the comma (0.01). The same happens with the Thai Baht.

The reason to establish a common incremental unit in Forex is due to the fact that differently to equities which are all quoted in the same currency, in Forex each currency can be quoted in any other currency. That makes sense, doesn't it?

If the exchange rate of a currency pair moves from 1.3000 to 1.3010, we say that the price moved up 10 pips. The pip incremental is what shows if a position is winning or losing. So you make money when the pips move in your favor in a trade.

An increment of a single pip has a certain value and in the case of direct-quote pairs (pairs quoted in US Dollars) that value is 10 US Dollar per standard lot, and 1 US Dollar per mini lot. Other currency pairs, like reverse quote pairs (with the USD being the base currency), and cross rates (pairs without the USD) will have different pip values.

If the pair ends in USD it's easy to deduce the pip value. If not, you will need to refer to a pip calculator to obtain the value, since these per pip values can vary in time even within the same currency pair.You can use our pip calculator.

Despite the fact that there are online calculators and that most of the platforms do the math for you, knowing how the pip value is calculated is something that really matters in your risk management. In order to calculate how much one pip is worth, the following information is needed: the trading size and the actual exchange rate of the pair to be traded. Moreover you may need the exchange rate of your account's currency to the US Dollar. Let's see some practical examples.

The formula to calculate the value of a pip can be divided into three categories:

1. Currency Pairs With Direct Quote (EURUSD, GBPUSD)

For currency pairs with direct quote the pip value is constant and doesn't depend on the current exchange rate of the pair being traded.

where the exchange rate is always the ask price.

Here is an example with the EUR/USD with the quote being 1.2599/1.2600.

However, to get the value of the trade in Dollars, then multiply € 12.6 by the current EURUSD quote:

This phenomenon is observed when the Dollar is the counterpart or quote member within the pair: the pip value is always the same.

In the above example, a EUR/USD standard lot represents 100,000 Euro which can buy 126,000 US Dollars at the exchange rate of 1.2600. Therefore, the EUR/USD currency pair could be expressed as 100,000 EUR / 126,000 USD.

If you buy the EUR/USD and it moved up by one pip to 1.2601 you have earned $10. You can see the difference by substracting the pair as 100,000 EUR/126,010 USD. The amount of USD has grown on the right side of that equation by $10- the value of the pip.

2. Reverse Quote Pairs (USDJPY, USDCHF)

For those pairs having the USD as the base currency the pip value measured in Dollars is calculated with the same formula as with direct quote pairs:

However, in reverse quote pairs the pip value in US Dollars changes depending on the current quote.

For example, exchanging a standard lot with the pair USD/JPY at the rate 107.00, the pip would be worth:

In these cases you don't need to exchange the pip value to US Dollars in order to get the face value of the trade, because the lot size is always in the base currency and so is the pip value.

3. Cross-Rates (GBPCHF, EURJPY etc.):

The pip value measured in Dollars in cross currency pairs is a little trickier.

For example: with the EUR/NZD rate representing 1 / 2.5040, or expressed in a standard lot, 100,000 EUR / 250,400 NZD at the current exchange rate, if the pair moves up one pip to 2.5041 then the position would have incremented 5,03 US Dollars per pip.

Too abstract? Alright, this is the formula:

where the base exchange rate is the current quote of the base currency against US Dollar, and the exchange rate is, like in the previous formulas, the current quote of the traded pair. Therefore:

For cross-rates the pip value is changing depending on the current exchange of the traded pair AND the base currency exchange rate to the US Dollar. Got it? Great!

The formula seems complicated because we are converting it to US Dollars. But if your account is in EUR and the traded pair is the EUR/NZD, then you don't need to input the base exchange rate in the calculation. Supposing you buy a standard lot of EUR/NZD, the value of the pip is:

The exchange rate fluctuates, so does the value of the pip! Despite being just a small nuance, this is one of the factors that accounts for changes in the behavior of a currency pair over time. The more expensive the value of a pip, the more cautious will traders be with that particular pair. That is why the value of the pip has an influence on the price action.

For professional investors trading large amounts paying 1 or 1.2 Dollar per pip can make a huge difference.

Now you know how to combine the two concepts of pip value and lots. Important to recall once more:

- When you buy or sell a pair to enter a position, the face value is calculated in the base currency, the first within the pair.

- When you close and exit a position, the win or loss depends on the amount of pips and on the pip value. The profit or loss is initially expressed in the pip value of the quote currency (the second). To determine the total profit or loss, you must multiply the pip difference between the open price and closing price by the number of units of the currency traded.

- The pip value can be calculated in different ways depending if the traded pair is a direct rate (pairs quoted in US Dollars), a reverse rate (with the USD being the base currency) or a cross rate pair (pairs without the USD).

Your broker-dealer might have a different convention for calculating the pip value relative to the lot size. Check it out while testing the platform.

As each currency has its own value related to another, it's important to take these factors into account to refine the money management at an optimal level.

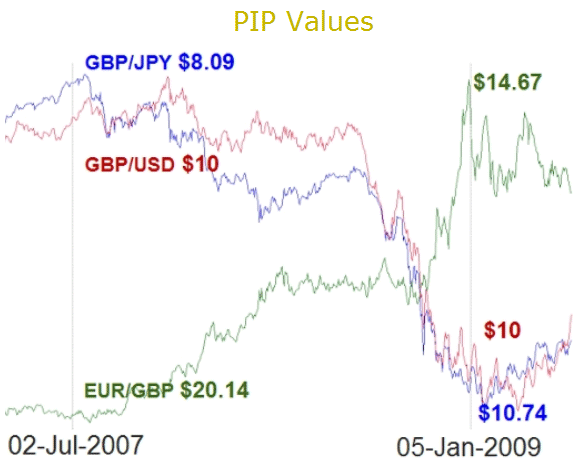

Supposing you were planning similar trades on the GBP/USD, the GBP/JPY and the EUR/GBP with the rates as of January 2009. The pip values expressed in US Dollars would be approximately:

where the value in brackets is the ask price of the exchange rates of January 2009.

In this scenario you should account for the fact that a 100 pip stop loss or 200 pip target trading the GBP/USD accounts for 46% more than in the EUR/GBP because of the difference in pip values.

If we take the rates in, let's say, July 2007, the differences where even greater:

At that time, there was a huge difference of more than 50% in the pip value (expressed in US Dollars) between the GBP/USD and the EUR/GBP. By comparison with January 2009, trading the GBP/JPY was cheaper in July 2007 in terms of pip values, while trading the EUR/GBP was more expensive.

The image below shows line charts for the three pairs and the corresponding pip values.

Depending on your account size, trading one pair or the other will bring a different volatility to your account balance. In fact, the pip value serves to fine-tune the value of a trade by measuring what your possible profits and risks are worth.

Another aspect to consider is that when the pip value is lower in one pair than in another, the risks that market participants are willing to take in this pair are probably wider in terms of pips. This may increase the daily range of certain pairs or the placement of stop orders as we will see further in this chapter.

The bottom line is that you could be taking riskier positions unintentionally if you don't know how to consider the pip values.

How large should an order be to move the EUR/USD by 1 pip? There is really no exact way to measure the amount of capital necessary to move a pair by one pip. It's not so the volume which moves an exchange rate, but a clear imbalance between the demand for a particular currency and its supply. The EUR/USD rate may require less capital to be moved during the Asian session as the market for these currencies is thinner compared to the New York session. Indispensable reads to unveil the mistery of price mechanics are the articles "Price Mechanism" at Wikipedia and Richar Olsen's "Pricing in the FX Marketplace".

In terms of risk management the lesson is not over yet! In order to calculate the real value of the trade you are now able to consider trading costs such as spreads or commissions and the pip value. But there is another intrinsic aspect of the Forex market to be considered: interest rates.

The Interest Differential (Rollover)

Forex traders make money either buying low then selling high, or selling high then buying low. Profits and losses are determined by the opening and closing prices and by the pip value as you have studied in the previous section. However, profits and losses will also be affected by the different interest rates of the currency pair - by when the trades actually settle and how long the position is held.

Rest assured that the importance of this topic can eventually represent an advantage to your trading. Let's proceed by recalling the concept of exchanging two currencies from the beginning of the chapter.

Every currency trade involves selling one currency and buying another. This exchange is the same as borrowing one currency to buy another. Since every pair consists of two currencies representing two economies with two different interest rates, most often it derives in an interest rate differential in the pair. This differential will, in turn, result in a net earning or payment of interest.

The interest that is earned or paid is usually the target interest rate set by the central bank of the country that issues the currency. More precisely, the interest rates used are the short term overnight LIBOR and LIBID rates, because most of the spot trades are short term. These are typically set by the British Banker’s Association and are changed on a daily basis.

Countries don’t change interest rates often, therefore the interest earned or paid can change on a daily basis but will typically not change very much. So a trader does not have to worry about timing the market too closely on this subject.

The interest is debited (paid) on the currency that is borrowed, and credited (earned) on the one that is bought, so that each pair has an interest payment and an interest charge associated with holding the position.

This means that if a trader is buying a currency with a higher interest rate than the one he/she is borrowing, the net differential will be positive and the trader will earn funds as a result.

Depending which member currency within the pair has the higher interest rate, on some pairs a payment may be made if you are buying it, and a charge may be made if you are selling it. But on other pairs, an interest payment may be made by selling it and a charge occurs when buying.

Most Forex broker-dealers automatically roll over the positions from one day to the other until the trader closes the position - a process called, naturally enough, a "rollover". Practically all trading platforms adjust the rollover to your account automatically, so you do not have to calculate it. This premium can also be called using the terms "swap", "tomorrow-next," or "cost of carry".

The rollover is necessary to avoid the actual delivery of the currency. As spot Forex is predominantly speculative, most of the time traders never request the actual delivery of the currencies they trade. Besides, delivering the currency is almost impossible with the leverage effect, because there is usually not enough capital to cover the transaction.

Since the amount of the rollover is determined by the interest rate differential, the greatest interest can be earned by buying the currency that pays the highest interest and selling the currency that charges the lowest interest.

This concept is the basis of the so called "carry trade", where profits are derived from earning accumulated interest differentials rather than by trading.

This is one of the favorite subjects of James Cheng. Here is a list of carry trade related articles from his blog at FXstreet.com.

If you are trading a strategy which relies on - or is sensitive to - interest differentials, you may consider opening an account specially for this strategy with the dealer offering the most consistently attractive premiums. Broker-dealers usually list those premiums and charge within their trading software or on their website.

Don't hesitate to call the broker-dealer and negotiate a more favorable interest rate.

Forex broker-dealers also charge some interest from the equation, so the exact amount of interest that you will earn or pay will vary from broker to broker.

Ask the broker-dealer's support team what it takes to get a higher rate. Remember, you are the client, you decide what to do with your money.

You don't know what the interest rates are for each currency? To see which countries currently have the greatest and lowest interest rates, and therefore identify the biggest differentials, you can check this table.

In accordance with the Islamic religious law some broker-dealers offer a type of account especially intended to Muslims as swaps go against their religious beliefs. In such broker-dealer accounts, no rollover will be applied. The so called "Shariah Law" is based on Islamic principles which Muslims are expected to follow in the various aspects of their daily living including banking and finance, and forbids all forms of interest. Please refer to our Arabic site to contact your Shariah law compliant Forex broker.

In the spot Forex market, delivery of the underlying is immediate as opposed to forward delivery. But as briefly explained in Chapter A01, the delivery is technically a two-day maturity transaction. This means that the exchange of funds, also called "settlement", takes place two business days after the entry date- the date when the trade has been accepted by the broker-dealer. The date of settlement is known as the value date or delivery date, as it refers to the date on which the foreign exchange deal is due to mature. Rollovers, in effect, continually delay the actual settlement of the trade until the trader closes his/her position.

Settlement for most pairs, often depicted as T+2, takes 2 days because most of the transactions are made between continents with different time zones. The exception are North American currency pairs, comprised of USD, CAD or MXN (Mexican peso), whose settle is 1 good business day (T+1).

As explained before, the net interest is either added or deducted from the trader’s account at the end of each trading day as long as the position is open.

Because currency trading is a 24-hour global market, there needs to be an agreement as to what constitutes the end of the day. By convention, the broker-dealer's settlement time or "cut-off time" is 5 P.M. Eastern Standard Time (EST) or 10 P.M. GMT in winter or 9 P.M. GMT in summer.

The reason this particular time is used is because according to the International date line, when it is 5 P.M. In New York, it's Monday morning in Australia and New Zealand hence it marks the beginning of a trading day and week.

At the settlement time (5P.M. EST), a new good business day starts. So for any trade opened at or after 5 P.M. EST on Monday, the trade day will be considered Tuesday. For a trade opened at latest 4:59 P.M. EST the trade day is still the day of the opening of the trade.

With these conventions in mind we can now deduce that a trade in EUR/USD opened at 2 P.M. EST Monday would settle on Wednesday at 5 P.M. because the trade day would be still Monday, and 2 full maturity days later is Wednesday at 5 P.M. EST. because the trade day would be still Monday, and 2 full maturity days later is Wednesday at 5 P.M. EST.

However, if the same currency pair were to be traded after 5 P.M., let's say at 8 P.M. on Monday, then the trade day would be Tuesday and the settlement date would be Thursday at 5 P.M. EST.

Moreover, for a T+2 currency pair that was traded after 5 P.M. EST on Wednesday, the trade date is Thursday. Now, if we add 2 good business days it would settle on Saturday. But because the market is essentially closed on Saturday and Sunday, the value is extended to Monday.

Since interest is calculated for every day while position is held, including weekends and holidays, the amount of interest credited or debited depends on the number of days between rollovers. If the rollover period is extended because of holidays, then the additional holidays are counted as well. This can lead to several days especially at the end/beginning of the year.

For trades opened on Wednesdays after 5 P.M. (or Thursday for a T+1 currency pair), the interest premium is triple the normal amount because there are 3 days instead of just 1 day between rollovers! That can have a negative impact in your trading costs, but if you pick deliberately a pair with a very high positive interest rate differential, this can act to your advantage. Very few traders consider these small nuances into their trading, but at the end of the year, they can represent a notable difference in your overall performance.

By the same logic, if you do not want to earn or pay interest on your positions, simply make sure they are all closed before 5 P.M. EST, the established end of the business day.

There are basically two ways that broker-dealers use to pay or charge this premium. One is through an actual payment or charge to your account balance, the other is by resetting and adjusting your position in a more or less favorable price depending if the rollover is positive or negative.

This process of resetting your position means simultaneously closing and opening it, so that if you are owed a premium your entry is reset to a lower entry price on a buy trade. Likewise, when selling and owing a premium, your entry price will be reset to be slightly higher, that means a less favorable one than it was originally.

On most trading platforms the premium is clearly visible on the control panel and also in the account statements. As mentioned before, many trading platforms or broker-dealer's websites will also show the amount of positive or negative rollover for each currency pair that can be traded, thereby informing the trader beforehand of the interest rate differential.

Also note that many retail broker-dealers do adjust their rollover rates based not only on the LIBOR short term rates, but also on your account leverage and account type. That is why you should check your broker-dealer on rollover rates and crediting/debiting procedures.

You may find that your broker-dealer is paying you a little less and charging you a little more than you may have expected if you calculate the rollovers by yourself. That means they are taking a portion of this premium as part of their service charges. Again, in order to avoid unnecessary pitfalls, check everything out before opening a real money account.

Still another issue: while it is common for these payments to be made around the end of a good business day at 5 P.M. EST, a few dealers may spread the premium into a continuous payment while the position remains open.

Now we are going over the rollover a little more in depth so that you understand how it is calculated - despite being an automated process in most cases.

As an example we will take the pair AUD/USD, which has been for a long time the one with the greatest rollover differential.

Imagine that you are long one mini lot (10k) on the AUD/USD and the current interest rates as defined by the overnight rate is 7.60% and 4.20% respectively. In order to net those two interest rates we calculate:

where 365 is the number of days in a year.

The formula explained in several steps is:

-

First you calculate the difference between the overnight interest rates of the two currencies involved in the pair:

(7.60 – 4.20) = 3.4Sometimes here you have to subtract a small percentage which is the portion that charges the broker-dealer for the service.

-

Second, the difference between the two interest rates has to be multiplied by the amount of the base currency held in the trade:

((3.4) X 10,000 AUD) = 34,000 AUD

-

Divide that amount by 100 (%) and then by 360 days to arrive at a close approximation of the interest premium payment in the base currency per day:

34,000 AUD / 100 / 360 = 9.444 AUD

-

If the base currency of the position you hold is different from the currency you hold your account in, convert it to your currency multiplying the above result by the current rate between the base currency and your account currency.

9.444 AUD X 0.8455 (AUD/USD) = $ 7.984

If you were short the AUD/USD you would reverse the first part of the equation and find the amount you should be charged to be holding that position.

An interesting aspect you can observe in the above calculation is that when borrowing and buying currency lots, the net premium, either positive or negative, is calculated in accordance to the size of the position.

Usually the trader has leveraged amounts of capital because the transactions, and the broker-dealer pays or charges a premium accordingly that amount of capital. That is why the rollover is dependent on the leverage. This is the next subject to understand the mechanics of trading.

In an educational and entertaining way, Rob Booker explains the interest differential process through carry trading, in the words of Harry Banes

I pulled out my notebook? and flipped open to the tab I'd marked "Interest Rates-Retail Carry Trade.” Then I began: “You talked about borrowing cheap money and then investing in high-interest currencies. I sat down for at least two hours and learned why it works. It makes perfect sense to me. A high-rated borrower has, in effect, a huge pool of capital to draw from. I realized that a wise investor should always look to borrow at the lowest rates and invest for the highest rates possible, combined with a reasonable expectation of return. I hadn't ever consider that, not because it doesn't make sense, but rather because it's just not something I would have though about."

George smiled. 2And now that you thought about it, what did you learn?"

"I learned that carry trades don't just invest in currencies. They also invest in US stocks, bonds from around the world, real estate, they even purchase entire companies with the borrowed money. There is a whole lot of borrowed Yen out there. But I will get to that point later. I am sure I am not telling you anything that you don't already know."

He nodded. “Probably true. But I have thirty minutes and I want to hear it all again."

I looked down over my notes. There was no possible way for me to get through everything in half an hour. But I plodded onward: “Once I had an understanding of why it worked, and believe me, it took me a while to figure it out, I realized that I could try to apply the same principles in my currency trading. I called my currency dealer and asked about interest rates. It turns out that retail currency platforms charge or pay interest in the same way that a bank would charge or pay interest. Only retail platforms call it a swap rate, and the interest is calculated at the end of every currency trading day - in other words, at five P.M. Eastern time."

"How much are they charging or paying out?"

"Well, for my research here, I used the British Pount versus the Japanese Yen, the GBP/JPY. Because interest rates in Japan are at zero, and rates in the United Kingdom are at 4 percent- and, I might add, expected to keep rising-when I buy one standard lot of the GBP/JPY cross pair in my trading account, which is $100.000 worth of currency, I get paid about $20 every day in interest."

"What kind of leverage do they give you?"

"That's my next point. I have 400:1 leverage with my dealer, which I know sounds ridiculous. It's a ton of leverage. But the leverage is almost irrelevant," I told him,"and this is where it gets exiting. I hope I haven't gone totally wrong with this research, because I think I stumbled onto something really amazing.

"Lets say that I open an account with Universal Currency Brokers. I put $100.000 in the account. I don't have that much money, but let's just say I do. I put up only $10.000 of that money for margin. And because of leverage, they let me buy $4,000,000 worth of GBP/JPY, or forty standard lots. Every day that I hold that currency, I get paid $20 for every standard lot, or $800. Just for holding onto the currency pair in a buy position. This sounds too good to be true, but I called around that night to at least 20 currency dealers. I found out that almost all of them are paying interest in those amounts. Almost all of them. I hope I'm okay so far."

George nodded. He looked at his watch. I could tell that I had captured his interst. He said:”I ordered in some sandwiches but I'm loosing my appetite while you talk to me about money.”

"Me too, I can eat later."

"Good. So far, this is fine research you've done. This is slightly different than the way it works for us, but it's perfect so far."

"I'm happy to hear that. If the research was faulty up to this point, I'd have nothing left to say. But here's what comes next: I though, it sounds too easy to just buy the GBP/JPY each day and try to earn $800. Why? Because the currency pair might fall, instead of rise. You know, if some news comes out, or if there is a terrorist act, the currency pair is going to bounce around. And for each standard lot traded, a pip is worth about nine Dollars. Say it drops 100 pips, and I've traded 40 standard. If the pair falls 100 pips in one day, I would loose 100 times nine Dollars times forty- that's 100 pips, times nine Dollar per standard lot, times forty standard lots traded. That's a lot of money. Way more than I would be earning from the interest."

"It's just not worth the risk then," he added.